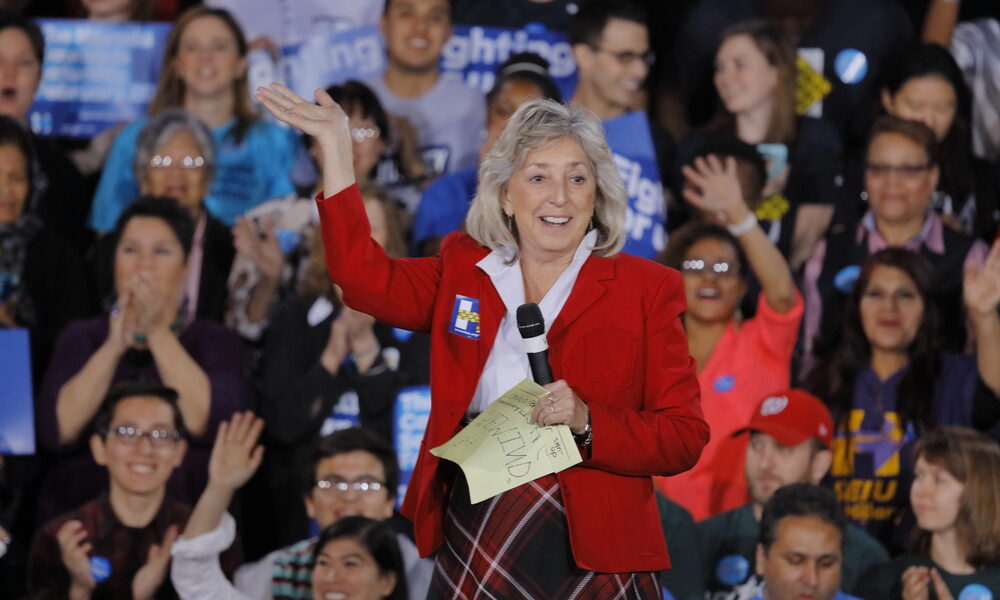

U.S. Rep Dina Titus of Nevada, co-chair of the Congressional Gaming Caucus, introduced on Monday the Fair Accounting for Income Realized from Betting Earnings Taxation (FAIR BET) Act that would restore the 100% deduction for gambling losses.

Titus and other lawmakers of pro-gambling states have rallied against the provision included in the reconciliation bill signed into law last week by President Donald Trump. Part of the 900-page legislation limits gamblers to deduct up to only 90% of their losses, which will generate $1.1 billion. Bettors can currently deduct 100% of their losses up to the amount of their winnings. The provision goes into effect in 2026 unless reversed by Congress.

“The recently passed budget bill included the tax provision inserted by Senate Republicans without consent of the House,” Titus said. “My FAIR BET Act would rightfully restore the full deduction for losses, so gamblers don’t pay taxes on money they haven’t won.

Titus told the Las Vegas Review-Journal that the provision is another attack on gaming and tourism.

“This also punishes people who are trying to do the right thing by reporting gambling on their taxes, pushing them toward offshore outlets and the predictions market, which unlike legitimate gambling sources, do not invest in bricks and mortar, pay state taxes, hire union labor, or contribute to problem gaming efforts.”

“The entire industry is freaking out,” said Victor Rocha, conference chair for IGA. “It will have an effect on tribes. There’s pain all the way across. I heard a gambler say we’ll just go offshore and won’t report it.”

The American Gaming Association supports the overall tax bill, but didn’t comment on the gambling-tax provision.

A Las Vegas accountant specializing in gambling warned, however, it could drive away gamblers and impact tax revenue overall.

“Did anyone think this through?” Russell Fox wondered in an article in The Washington Post. “They thought, ‘We’ll bury this somewhere in the bill. No one will see it and now we’ve got $1 billion of income to offset $1 billion of tax cuts.’ This is bad long-term for the casino industry. It’s bad for gamblers. It’s actually bad for the IRS, too. We need a less complex tax system.”

Professional poker player Gil Galfond said last week on X that the provision “would end professional gambling in the U.S. and hurt casual gamblers, too. You could pay more in tax than you won.”

Galfond later said he may have come on too strong, saying it would end professional gambling, and indicated, “Many pros will no longer be able to make it. But the big winners will remain. It may be much worse for sports bettors.”