In this week’s issue:

- Super Bowl LVIII beat all betting records even Chiefs win hit sportsbook margins.

- More Super Bowl: downloads, geolocation transactions, Las Vegas books.

- Catena Media: long road back.

- New York baby! ESPN Bet snaps up Wynn license for $25m.

- News shorts: ICE move, Barstool-DraftKings, PrizePicks.

Sun shines on KC as books feel the heat on margins

KC win drives negative margins: Totals wagered were close to the $1.5bn predicted by the markets, but the Kansas City Chiefs’ Super Bowl win over the San Francisco 49ers led sportsbooks’ hold levels into negative territory as they recorded -4% margins for Super Bowl LVIII.

- The Macquarie team said this “was not as bad” as the worst case scenario that had Kansas winning with a points total of more than 47.5pts, which would have led to a negative hold of -14%.

- Best case scenario: A San Francisco win “in a low scoring game” could have led to 30% margins and driven “$450m of market GGR and $315m of NGR (~30% promo/GGR)”, added Macquarie.

- JMP said operators likely had a mixed outcome as the game “pushed into overtime, a negative within itself”, which enabled “several more prop bets (50% to 60% of total wagers) to hit, including a Kansas City win, and acted as headwinds for margins”.

- OSB hold for the Super Bowl was between -5% and 0% vs. 2023 industry average of 9.2%, said JMP.

- Q1 impact: The -4% hold for the Super Bowl will result in a $64m drop in GGR for the market and should “result in 2-5% of downside to Q1 consensus revenue”, noted Macquarie.

- Big Apple offset: But with January’s high hold rate of 10.8% in New York not reflected in forecasts, this “more than offsets the Super Bowl result with an incremental $250m of market GGR in Jan24”, Macquarie added.

- Record audience: The analysts added that Super Bowl LVIII would likely be a turning point for “customer acquisition and NFL growth in new demographics”. This year’s event hit viewership records, with CBS Sports reporting that more than 123 million viewers watched the game, making it the most-watched sports broadcast in U.S. history.

- This was “partly driven by over 50% of the U.S. population now having access to OSB in addition to Taylor Swift’s involvement, which has brought interest from a whole new demographic, mostly women, we view Super Bowl LVIII as unequivocally positive for sportsbooks”, said Macquarie.

- GeoComply said betting geolocation transactions had increased +22% YoY since the start of the NFL playoffs in January, with active user accounts up 12% and “transactions and actives +35% and +13% YoY respectively” in the final round of playoffs.

- The company added that several NFL stadiums saw over 60,000 on-site betting transactions per game through the regular season. The Bengals stadium had 67,000 transactions, “against a stadium capacity of 65,500, this implies at least one bet per spectator per game”, the group said.

Break it down: JMP meanwhile said parlays accounted for 34% of bets and 25% of handle. FanDuel’s average bet size of $22 was well below the average industry bet size, implying a heavy skew toward parlay betting for the company, noted the analysts.

- The average number of legs was 5.1 for each parlay wager and was “most impactful for DraftKings and FanDuel”. Single bets accounted for 74% of handle and 66% of all bets and 17% of bets were tied to a promotion.

- In the two weeks leading up to the Super Bowl, U.S. app downloads were flat YoY and totaled 1.4 million, while on Super Bowl Sunday they were 38% down on 2023 at 295,000.

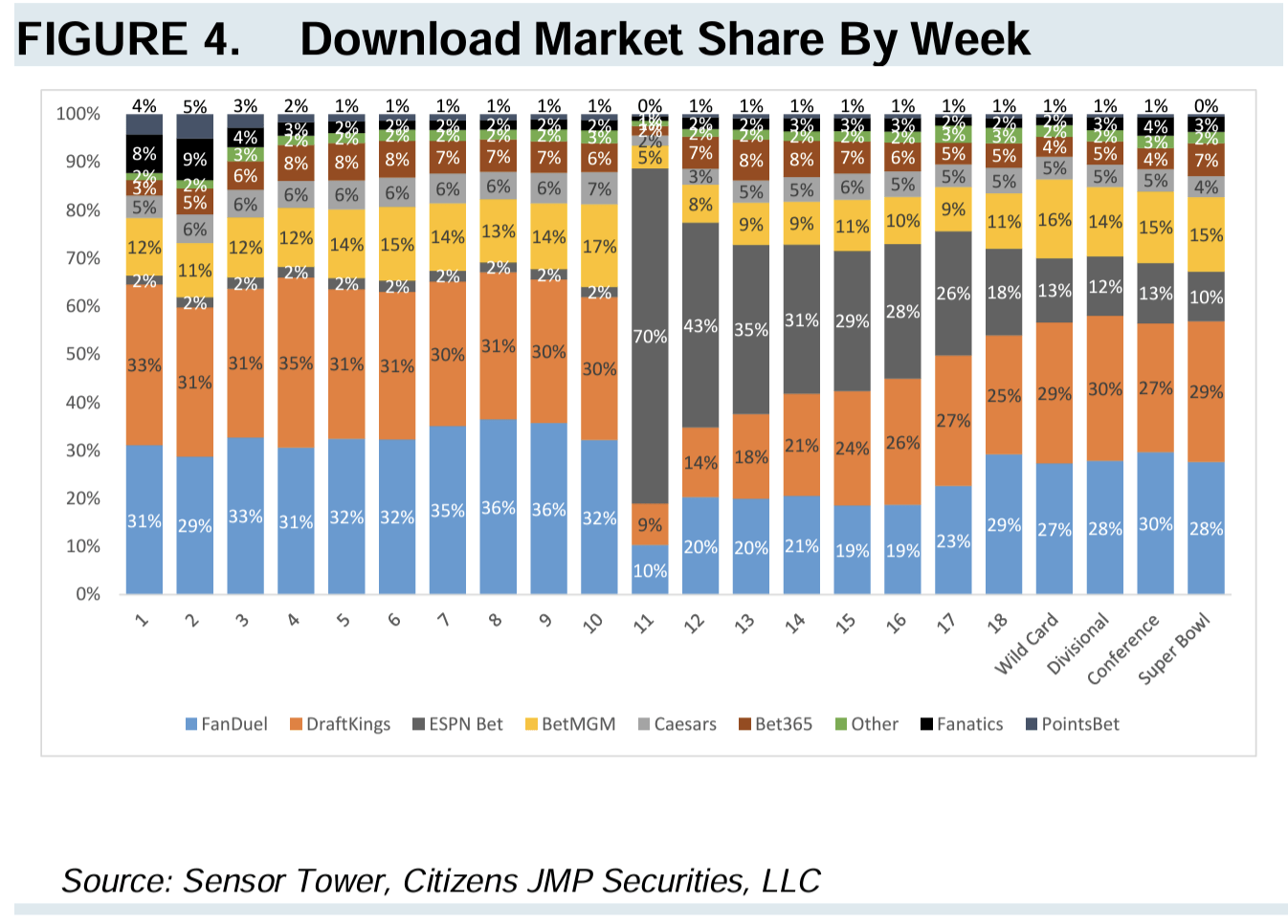

Download charts: FanDuel had 28% download market share (-12% YoY), DraftKings 29% (-22% YoY), BetMGM aired a commercial during the game and its 15% download share was +12% YoY.

- Caesars had 4% share (-5% YoY), while ESPN Bet was up 192% with 10% share. Bet365’s download share of 7% was +50% YoY and Fanatics dropped back to 3% share after hitting 6% two weeks ago.

More records: The Nevada Gaming Control Board said sportsbooks took a record $186m in wagers on the game and generated $6.8m in revenue while FanDuel said it took $307m in wagers on the game, also a new record for the U.S OSB leader.

Model shift leads to 41% drop in “weak” Q3 for Catena

Long road back: The U.S.-focused sports betting affiliate Catena Media said Q3 had been “weak” and the group was aiming to return to profitability in H224 as a set of “extensive investments” in tech and AI led to a 41% drop in Q3 revenues to €14.5m.

- Hard shift: CEO Michael Daly said the shift from CPA to a revenue share model was the main reason for the decrease and North America, which generates 85% of the group’s revenues, was down 43% YoY to €12.3m while adj. EBITDA dropped 88% to €1.5m.

- Latin America is a key region for Catena and Daly said the group has invested in “a number of sites focused on markets such as Brazil”.

- Launch timings in the region’s largest economy remain unclear, but “regulations are due at the end of March” and Catena is focused on understanding what operators require from affiliates, said Daly.

- With “100 plus operators” understood to be applying for licenses, the group will focus on understanding “how that process is going to work”, said Daly.

ESPN Bet heads to New York

Penn Entertainment, parent company of ESPN Bet, is heading to New York after it revealed that it had acquired Wynn Bet’s New York mobile sports betting license for $25m.

- The transaction gives ESPN Bet market access to the largest OSB state in the U.S., with launch set for this year “pending regulatory approvals”.

- Jay Snowden, PENN CEO and President, said: “This important development will bring ESPN Bet to the largest regulated online sports wagering market in North America. Together with ESPN, we’re building a brand that is synonymous with sports betting, and operating in the New York market is key as we grow ESPN Bet across the U.S.”

- New York sports betting handle was down 4.5% in January to $1.9bn on a monthly basis, but GGR hit a monthly record high of $211.5m.

News shorts

ICE cap: This year’s edition of ICE was the last one to take place in London as from next year it will be held in the Catalan capital Barcelona. Asking exhibitors what they thought of Barcelona as the new venue for ICE, there seemed to be a clear split on whether the respondents worked in land-based or online gaming.

- The former were very happy with the move, while the latter bemoaned the fact that ICE was moving “when everything is here in London”.

- The reason ICE is moving to Barcelona is due to Brexit, which has seen the UK leave the European Union and withdraw from the Single Market and Customs Union. As a result the UK now imposes import tariffs on European companies bringing in gaming equipment and machines into the country.

- These are understood to have significantly pushed up the price of exhibiting at ICE and led major gaming suppliers to pressure event organisers Clarion Gaming into moving.

- It’s a big loss for London and all the subcontractors, hotels, catering companies or party organizers that derive work from ICE, which is understood to be the second biggest business event held at the Excel London venue.

Barstool Media founder Dave Portnoy confirmed the long-mooted marketing agreement his company had signed with DraftKings that will see Portnoy and his team promote the betting brand to the Barstool audience.

Bad pick: Fantasy betting operator PrizePicks will no longer offer its ‘pick’em’ daily fantasy sports games in New York as of this week, the company notified its users on Monday following the Super Bowl. The company has also agreed to pay $15m to the state’s gaming regulators for operating without a license.