Hello and welcome to this week’s Igaming Focus newsletter!

On the slate this week:

- Sportsbooks and icasino benefit from strong November bounce

- Big three gaming jurisdictions also on the up

- Betting app downloads update

- Sweepstakes update

- Senate hearing on OSB proves inconclusive

- News shorts

Have a great holiday season and see you in 2025!

Source: Shutterstock

November OSB and icasino rebound from weak October

Punter-friendly results of previous month reversed as key metrics shoot back up

Trending strong: With data in from 12 states, the Jefferies team said OSB trends and “encouraging igaming data” meant November should be a strong month for the industry, with handle up 8%, gross gaming revenue up a whopping 83% year over year, and margins up +4.5ppts to nearly 11%.

- However, they added that November 2023 was “a weak comp” period as it recorded margins of just 6.4% due to customer friendly NFL results.

- Don’t look a gift horse in the mouth: Still, the market is tracking at +30% with margins up 1.3ppts to 9.2% in the fourth quarter to date and for the major brands, November GGR is at +103% for FanDuel, +79% for DraftKings and +109% for BetMGM, with margins up for all three of them.

- Online casino also had a good November, with West Virginia delivering another record-high GGR performance and growth at +72% YoY.

- Recycling job: Jefferies pointed out that West Virginia “represents only a low-single-digit share of the wider market” but should be seen in the context of “October’s record GGR in all five commercial states [being] largely due to exceptionally weak sports margins and customers recycling winnings from OSB to igaming.”

- Another positive was that as sports margins normalized in November, “igaming GGR has further accelerated to a new high in West Virginia, implying a greater degree of sustainability.”

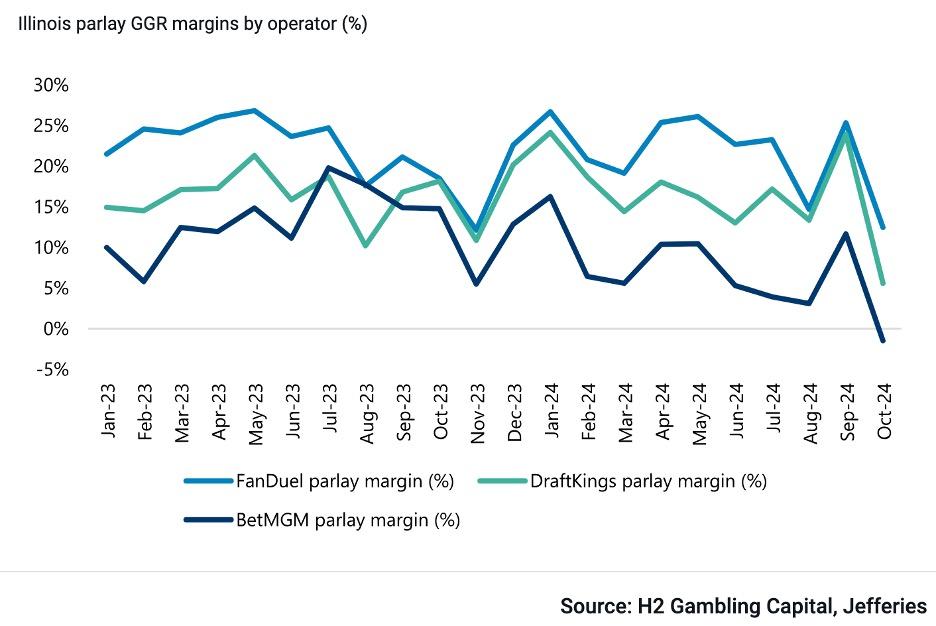

Parlay benefits: FanDuel’s lead on the key OSB product in Illinois was underlined by October parlay data from Oregon showing “that even when affected by the most unfavorable stretch of sports results ‘ever seen’, parlay margins (8.8%) were still as good as peak singles margins (8.8% peak over the LTM),” said Jefferies.

Big three states on the up

Following on from Jefferies’ update, the leading U.S. jurisdictions of New Jersey, Pennsylvania and Michigan all experienced a strong November, with New Jersey icasino handle up 25% to $214m and sports betting up 24% to $119m.

- Pennsylvania icasino was up 27% to $201m and OSB +110% to $98m, while Michigan icasino was up 29% to $226m and OSB increased 72% to $58m.

- BetMGM continued its handle growth in New Jersey where it now enjoys 22% market share, with FanDuel and DraftKings nearly tied at 27% and 26% respectively.

- JMP said Fanatics’ 2.3% market share gain was its highest ever as it continues to focus on high spending players and VIPs.

Market leaders continue dominance of betting app download market

App downloads continue to underline FanDuel lead

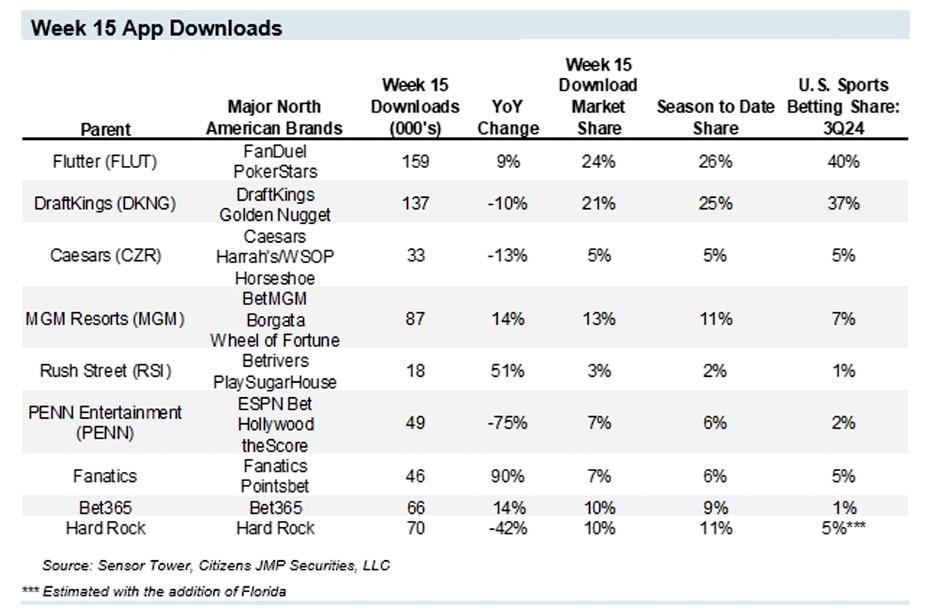

Just the 1%: The U.S. and Canadian sports betting markets saw a total of 664,000 app downloads during NFL Week 15, a 19% year-on-year decline, according to latest analyst data. Excluding the recent launch of ESPN Bet, downloads were down just 1%, reflecting what has been a stable market for the 2024 NFL season so far, JMP said in a note released on Tuesday.

- This is a stark contrast to the more volatile shifts in download market share seen in 2022 and 2023, highlighting operators’ tightened customer acquisition strategies.

- Market leaders FanDuel and DraftKings have maintained dominance, making it increasingly challenging for competitors to drive market share gains without breaking through acceptable customer acquisition cost thresholds, JMP noted.

- This restraint has pressured Penn Entertainment and BetMGM, both of which have delivered underwhelming results despite heavy investments in their online betting divisions.

- In 2024, the two operators are forecast to post a combined EBITDA loss of $695m, with losses in sports betting expected to significantly exceed this figure. While igaming remains a positive contributor, these sports betting focused losses have offset gains.

- State level market share data further illustrates the struggle, with BetMGM gaining less than 1% share year to date and Penn’s North American market share hitting its lowest level in November following ESPN Bet’s launch.

- If the restrained approach to promotional spending across the industry continues, DraftKings and FanDuel are well positioned to maintain their lead into 2025, JMP concluded.

Lobbying galore during NCLGS winter meet

Sweepstakes in the crosshairs for the foreseeable

Briefing days: Sweepstakes companies had a good day in court recently, but their activities will continue to be the focus of much of lobbying next year as last week’s winter meeting of the National Council of Legislators from Gaming States in New Orleans played host to further briefing against the sector.

- One-man lobbying machine: Most of it seemed to be led by Howard Glaser, head of government affairs at Light & Wonder, who according to one industry contact at the event told lawmakers that going after sweepstakes operators was a “no risk” gambit that would be supported by “every type of legal gambling that you have in your state.”

- He also handed out a copy of an in-depth article that claims to outline live casino market leader Evolution’s activities in illegal markets and was later seen distributing a critical Washington Post article about sweepstakes operators.

No clarity for OSB following Senate hearing

Twists and turns: Yesterday’s Senate hearing on sports betting took some unexpected turns and detours, but produced little clarity in relation to actionable measures or whether federal regulation was more or less likely following the different contributions from the speakers.

- Deutsche Bank said the hearing produced more heat than light and the real meat would be in the follow-up to the testimony or the absence of it.

- “We find the lame duck timing of the session rather unusual, though interpreting the timing, and the implications, is challenging. The regulatory and media scrutiny around the industry is elevated at present, though we don’t know that today’s hearing does more to illuminate this view.”

News shorts

Bet365 is set to enter the Illinois OSB market after its licensing was approved by the Illinois Gaming Board last week. The bookmaker will work in partnership with Walker’s Bluff Casino on developing an in-person wagering solution and an online sportsbook. Illinois is the twelfth state in which Bet365 will be active.

FanDuel has launched its latest responsible gaming tool called ‘My Spend’. The product is available on FanDuel’s sportsbook, casino, fantasy and racing platforms and is designed to help customers better understand their gambling patterns.

Nevada’s Gaming Control Board is evaluating whether to add a licensing process for betting data suppliers that supply lines and odds for sporting events.