Do you understand how prediction markets and contract derivatives are now being used to make sports bets? And more importantly — do you care?

For most of us, the honest answers are: “No” and “Yes.”

- No, we don’t really understand them yet.

- Yes, we absolutely need to pay serious attention.

These emerging markets pose a genuine threat to the current licensed and regulated gaming industry and to the tax revenues that support local, state and tribal economies.

The growing threat

The American Gaming Association (AGA) recently launched a live webpage showing gaming tax dollars lost since prediction-market operators began offering “sports event contracts.” That’s money no longer flowing to schools, infrastructure, and/or community or tribal programs. Here’s a link to that growing meter.

So, what exactly is a “Prediction” bet?

According to Wikipedia: “Prediction markets (also called information markets, decision markets or event derivatives) are open exchanges that let participants trade contracts tied to future outcomes, using financial incentives to aggregate predictions.”

It sounds academic. It’s not. While many of the bets are political, financial or celebrity-based, they are most often just sports bets that are repackaged, rebranded and operating largely outside the regulatory framework. They are licensed only by the federal government, which currently has very lax regulations giving the states and/or tribes virtually no control over this form of gambling in their jurisdictions.

Unlike conventional sportsbooks, which have fixed odds set by a bookmaker, prediction prices are dictated by supply and demand among participants (aka “investors”), reflecting the collective sentiment of the players involved.

You might consider these wagers like you would the share price of a publicly traded company. The share price is not necessarily set by a company’s performance, but how investors feel about the company’s future potential and how they think the share price will move up or down.

The actual sports “Predictions” or “Contracts” are simple Yes/No questions (e.g. Will the Philadelphia Eagles win this weekend?). If they win, the bet is worth $1; if they lose, it is $0. Then you can buy shares on that bet. Given the Eagles’ record, the shares in that bet would probably sell closer to $1 (like $0.84 to $0.87/share). Those prices would be set by the investors, not any bookmaker. The prices could go higher or lower, minute-by-minute, depending on how much interest there is in the game and how strongly investors feel about the outcome.

At 87¢, if the Eagles won, you would gain 13¢ for each share you purchased. If you bought the Jets at 13¢/share, your profit would be 87¢/share purchased. Of course, you could lose all of your investment (especially if you bet on the Jets. LOL).

How do these Prediction companies make money? They can either take a small percentage fee on each bet or, more commonly, take advantage of the differences between the “bid” and “ask” prices for the shares. These bid and ask prices can be continuously updated prior to the event. This is pretty much how Wall Street trading firms also profit.

Unlike most sports bets, you can also trade your shares. Suppose you bought the Montreal Expos to win the World Series at the start of last season. The price might have been as low as $0.20 or $0.30. Near the last week of the 2025 MLB season, you might be able to re-sell these same shares for 80¢ or more. You could cash out early and make a nice profit without waiting for the final at bat (when the Expos lost).

While they seem new, Prediction bets (like sport bets) go back hundreds of years. But the earliest form of the modern electronic prediction market came from the Iowa Electronic Markets (IEM) in1998, run by the University of Iowa. They allowed you to trade shares on the George H.W. Bush v. Dukakis presidential race.

It wasn’t long before sports entered the arena buoyed by the internet, AI and mobile technologies.

A little perspective

I’m hardly a newcomer to sports wagering, though I sometimes feel like one these days. Growing up in Reno in the 1960s, my high-school classmates and I filled out parlay cards lifted from local sportsbooks. We compared picks on college and pro games for bragging rights. Lunch money wasn’t at stake, but reputations were.

For decades afterward, little changed in the betting world except for the amounts wagered. Then came 2018 — and everything changed (see “The Legal Backstory” below).

Technology has also revolutionized the game. Online platforms, real-time stats, computerized phone banks and mobile access transformed occasional bettors into daily participants. Wager sizes exploded, with some pros like Billy Walters placing six-figure bets each week.

Historically, sportsbooks rarely generated huge profits; their margins (then and now) were always slim, often trailing behind racebooks, poker rooms and bingo halls. However, the explosion of online products and a younger audience steeped in Daily Fantasy Sports (DFS) changed all that.

Volumes have now exploded and are “massive.” As any Walmart or Amazon executive can tell you, even a modest percentage of a huge volume can yield substantial sums.

The legal backstory: PASPA and UIGEA

Two federal laws shaped the betting landscape and opened the door to the “prediction markets.”

PASPA (1992) – The Professional and Amateur Sports Protection Act outlawed sports betting nationwide, except in states with existing books (Nevada) or limited sports lotteries (Oregon, Delaware and Montana).

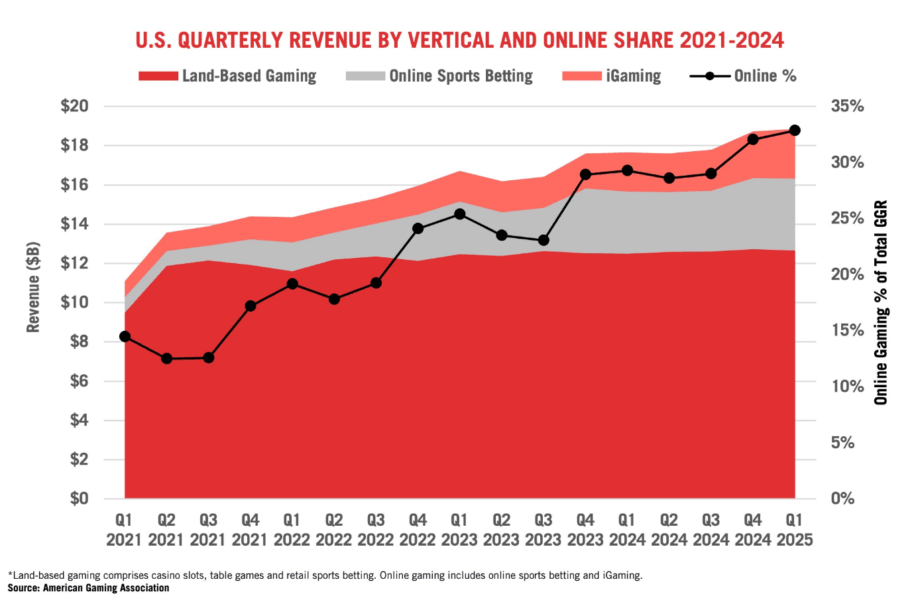

That changed when the Supreme Court struck down the law in 2018 (Murphy v. NCAA), igniting the modern sports-betting boom. The chart below from the AGA shows the incredible growth of online wagering from 12% of all gaming revenue at the beginning of 2021 to 32% at the beginning of this year. Today, 38 states allow sports betting and a few more are considering it.

UIGEA (2006) –The Unlawful Internet Gambling Enforcement Act targeted online gaming payments, especially from the live poker sites. But on October 13, 2006, this law virtually shut down that segment. However, there was an important exemption for fantasy sports, paving the way for FanDuel (2009) and DraftKings (2012) and the resulting explosion of interest in sports.

They, and others like ESPN, introduced younger audiences to gaming and mobile wagering. That was also a future gateway to prediction trading. UIGEA is still the law today, but it does not ban all online gambling; instead, it prohibits payments to “unauthorized” gambling sites, leaving the prediction market to operate under federal authorization.

Wall Street meets the sportsbook

Enter Kalshi, founded in 2018 by Tarek Mansour and Luana Lopes Lara and backed by Charles Schwab, Robinhood and others. Their original goal: help investors hedge against uncertainty by buying contracts tied to real-world business or political outcomes like interest-rate changes or election results.

After an 18-month process, the Commodity Futures Trading Commission (CFTC) granted Kalshi a federal license in 2020 to operate as a “designated contract market.” They aggressively expanded into sport contracts. They even signed a licensing deal with the NFL. Their activities are essentially federally approved sports bets with none of the state-level oversight, taxes or safeguards that legitimate operators must meet.

Kalshi released a recent poll showing: “9 in 10 voters say Americans should have access to prediction markets, viewing them as financial investments, not gambling, with broad bipartisan support.”

In contrast, Nevada Gaming Control Board (NGCB) member and former judge George Assad recently put it: “A derivative contract, whatever you want to call it, is nothing more than a sports wager. Every bet made in this town is a contract. You can call it a derivative; you can call it a credit default swap. It’s still a sports bet.”

Last month, the NGCB ruled that Kalshi can no longer take wagers in Nevada. But a Nevada Federal Court judge quickly gave Kalshi a temporary stay. However, just last week, that same court said they were reconsidering that action and may reverse their ruling.

Crypto.com and more legal battles ahead

Crypto.com, another major prediction player, bills itself as “the only place for sports event trading.” Its partnerships span the globe from Formula 1 to hockey’s LA Kings (who play in the Crypto.com Arena) to international soccer’s Champions League and the popular Ultimate Fighting Championship league (UFC).

Crypto recently sued the NGCB in Nevada federal court, claiming the state had no jurisdiction since they complied with all federal laws. They lost. As of November 3, 2025, they agreed to stop taking wagers in Nevada…for now. They vowed to appeal.

Meanwhile, Kalshi is suing the New York Gaming Commission under similar arguments. They also claim they are operating under federal CFTC oversight and therefore the states lack the authority to stop them. It will be interesting to follow that case since it is unfolding in a Manhattan court, right in Wall Street’s backyard.

In a recent webinar, influential tribal activist Victor Rocha said, “With prediction markets, we have to go state by state and prepare everyone to start filing these lawsuits. When this goes to the Supreme Court, it’s not going to be a tribal issue. It’s going to be a states’ rights issue. This will keep being an unanswered question until we get to the Supreme Court.”

Shayne Coplan, the CEO of Polymarket, had a similar opinion but counted on a different outcome. At an Axios event last week, he blasted traditional sportsbooks as a “scam” and said he expects the Supreme Court to eventually decide whether prediction markets can offer his version of sports betting.

Political and regulatory fault lines

Some in Washington are going on the counteroffensive. In a September 30, 2025, letter, seven U.S. Senators (including both from Nevada) warned the CFTC:

“The Commission must not override state and tribal authority by permitting companies to categorize sports betting as ‘event contracts.’ Doing so allows them to bypass age requirements, licensing, and consumer protections that exist in regulated markets.”

Their concerns are well-founded. Allowing prediction contracts to masquerade as financial instruments undermines decades of careful state gaming regulation and threatens to shift power (and revenue) to Washington D.C.

As Business Insider said in an article two weeks ago, “Basically, an 18-year-old in California can bet on a Dodgers game on Kalshi now since it is considered a federally regulated event contract. If it’s sports gambling, that’s illegal in California.” Even if it were allowed, most states put the age limit at 21. In those 38 states where sports betting is legal, they still have tax, age and other restrictions that prediction markets don’t have to follow.

Do you think that’s a fanciful exaggeration? It’s not. Just last week a California U.S. District Court rejected a preliminary injunction from three tribes who sought to ban Kalshi from offering their sports event contracts on reservation land. The judge ruled against them, but added in her written opinion, “Kalshi may have found a way around prohibitions on interstate gambling that were created with the Tribes’ best interest in mind.”

The Trump factor

Don’t count on any help from the current administration. In January, Donald Trump Jr. joined Kalshi, and their main competitor Polymarket, as a strategic adviser. President Trump has also enthusiastically supported Kalshi’s young founders and their firm now valued at $11 billion.

Three weeks ago, Truth Social, a division of Trump Media, announced a new partnership with Crypto.com, becoming the first social media platform to offer integrated prediction betting.

Around the same time, the President nominated Mike Selig as the new CFTC chairman. In 2024, Selig co-authored a letter arguing that it was “arbitrary and capricious” to ban sports event contracts. So, it seems unlikely that he, or the CFTC, will do anything to slow these bets in the future.

To many, this looks like a coordinated conflict of interest. The result could be unprecedented federal and administrative encroachment into gaming, which has always been the jurisdiction of states and tribal nations.

Industry response: “If you can’t beat them…”

In what some view as a defensive move, Caesars Entertainment recently confirmed it is exploring entry into these prediction markets. Draft Kings and FanDuel are already transitioning to prediction bets with new partnership deals. But so far, few brick-and-mortar competitors agree.

Many are standing firm in their opposition. In a sharply worded statement, American Gaming Association CEO Bill Miller warned: “Despite the CFTC’s request to halt trading while it conducts a review, both companies have proceeded. This defiance sets a troubling precedent — one that could lead to unregulated betting marketplaces operating outside state laws and integrity partnerships. It also raises serious consumer-protection concerns.”

Probably based on those comments, both FanDuel and DraftKings resigned from the AGA this week.

Pitfalls on the road ahead

Just this month, the recent NBA point-shaving scandals, rigged pitches in Major League Baseball and stories of UFC match-fixing have raised new concerns about sports integrity. And it’s not just big-time sport. Issues are brewing in everything from disc golf and surfing to darts and ping pong. Last week The Washington Post reported, “The number of wagers on table tennis matches flagged as suspicious rose from five worldwide in 2019 to 36 in 2024, according to data collected by the International Betting Integrity Association (IBIA).” The Post’s story speculated that the “bribe” money in many of these minor sports often exceeds the salaries of the top players, making them more susceptible to corruption (unlike the millionaires playing in the Big Leagues).

Despite the successful efforts of monitors like IC360, Sports Radar and the IBIA to spot suspicious betting, federal regulators may still use these new cases to expand their gaming reach under the guise of “consumer protection.” The truth is their lax betting regs could leave “consumers” even more exposed to fraud and abuse.

Could we eventually see Prediction markets inching their way into our bread-and-butter world of slot machines? It’s not impossible. Bingo-based Class 2 games and Historical Horse Racing (HHR) machines once seemed highly unlikely. The same goes for the lottery or pull tab-based slot games of New York and Washington states. If Prediction grows and branches out, it could be the next RNG substitute. Stranger things have happened.

Final word

For now, regulators like the NGCB are holding firm reminding these new “markets” that Nevada still sets the gold standard for gaming integrity. One official summed it up best in four simple words: “The gig is up.”

Let’s hope he’s right. But no matter what the share price, I wouldn’t bet on it.

# # #