A key congressional effort to reverse a controversial change in federal gambling tax policy stalled late last year. The US House Rules Committee declined to advance the Fair Accounting for Income Realized From Betting Earnings Taxation Act, known as the FAIR BET Act, as an amendment to the 2026 National Defense Authorization Act. This decision leaves in place a reduction in the gambling loss deduction scheduled to take effect in the 2026 tax year.

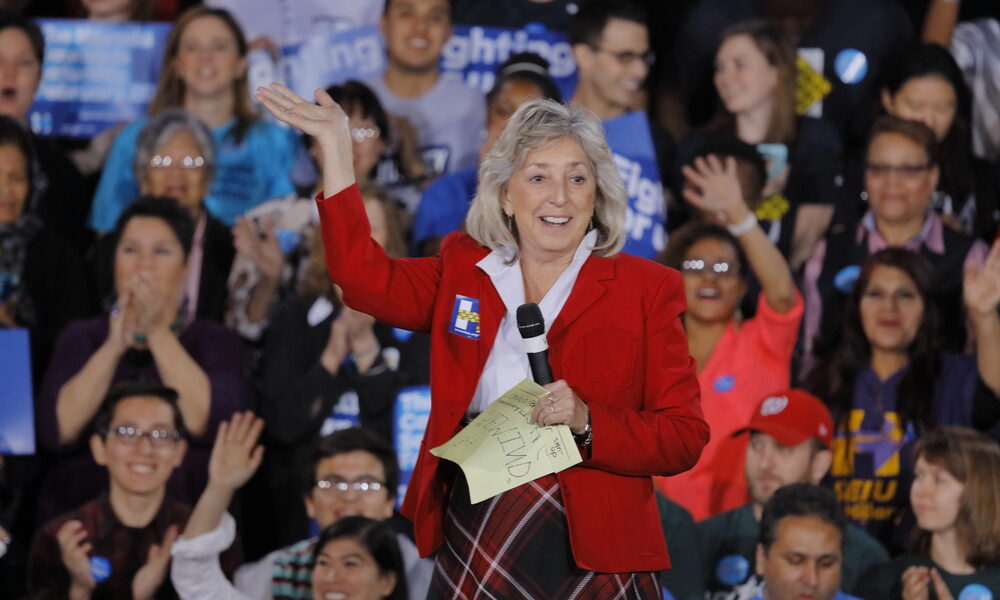

The bill was introduced by Rep. Dina Titus, D-Nev., whose district includes Las Vegas and other major gaming hubs. The FAIR BET Act sought to restore the longstanding federal practice allowing bettors to deduct 100% of documented gambling losses from winnings on federal tax returns.