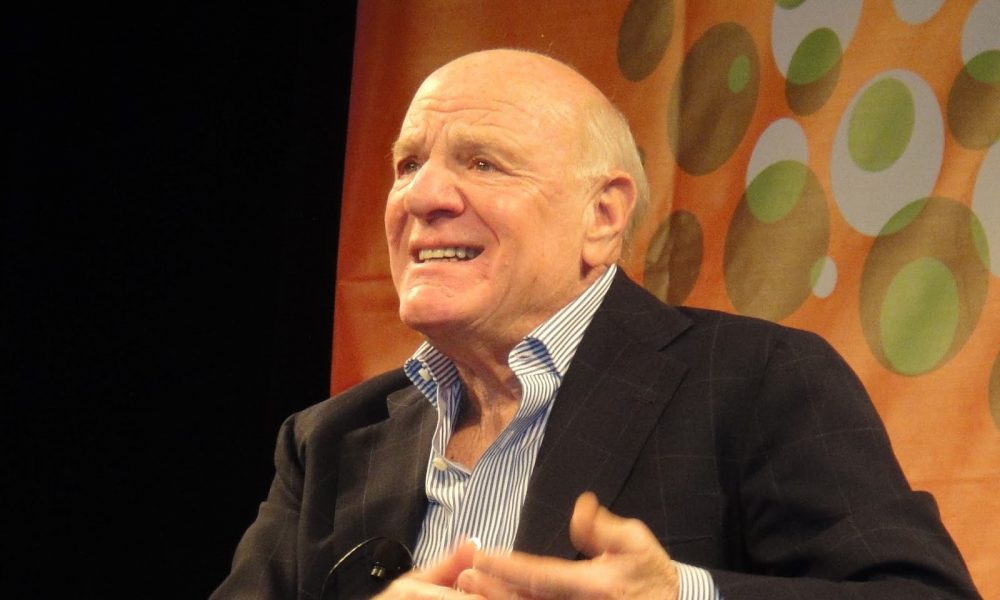

In a meeting that shone a spotlight on digital gaming and sports betting and its challenges, Nevada gaming regulators Wednesday recommended media mogul and IAC Chairman Barry Diller and its CEO Joey Levin be licensed in the state as part of the company’s 14% ownership stake in MGM Resorts International.

Levin cited the potential for MGM’s growth in the digital space for their interest in investing in the company. Later in the Nevada Gaming Control Board hearing, a Wynn Resorts executive told the board about their pulling back on digital spending in a competitive sports betting marketplace.

During the summer of 2020, IAC, a publicly traded company, spent more than $1 billion to purchase 59 million shares, reported as a 12% ownership stake. The two assumed positions on MGM’s 14-member board of directors.

On Wednesday, MGM announced its board authorized a $2 billion share-repurchase program that will increase value for the company’s shareholders.

Diller, chairman of Expedia, founder of Fox Broadcasting Company and USA Network, and former chairman and CEO of Paramount Pictures, has maintained that MGM’s potential for its online business drove the decision.

Levin told the board Wednesday that it was a usual step to purchase stock in a publicly traded company like MGM Resorts, but they saw the opportunity after gauging the marketplace after the onset of the COVID-19 pandemic.

“We were in March 2020 and looking at what’s happening in the world and how IAC was in a stable place. We were looking at what opportunities were out there,” Levin said. That led them to pursue investments that had a digital upside or transformational element.

“As we looked through many businesses in this period, we were trying to work to find opportunities and MGM kept hitting all of our filters,” Levin said. “It’s clear MGM had the capital to make it to the other side, post-COVID. It checked all of the other boxes in terms of business opportunities. We also saw a transformational omnichannel experience, which MGM had already been executing in an impressive way. We see the opportunities continuing to expand for them in addressing customers both physically in properties in Las Vegas, regionally, and digitally where markets have opened up.”

The digital marketplace was also the focus when the board took up the routine matter of Wynn Resorts’ application for a delayed public offering.

In November, company executives said they’re taking a longer-term approach to Wynn Interactive and not aggressively spending on marketing and promotions to attract customers, a move that is more economical and better for shareholders. Wynn also terminated a merger that would have combined Wynn Interactive with Austerlitz I.

Vincent Zahn, senior vice president and treasurer of Wynn Resorts Limited, said Wynn was one of the first companies in the digital gaming space to acknowledge how competitive the landscape has become, particularly for sports betting.

“In the fourth quarter of last year, we decided to retrench and build a business that creates long-term shareholder value and a long-term sustainable and profitable business,” Zahn told the board. “We cut back on media spending. We cut back on performance marketing. And we shifted the business model to more of an affiliate-based customer-acquisition model, given, in our opinion, the irrational cost of acquisitions metrics out there in the industry.”

Zahn said they reduced their cost of user acquisitions and that the burn rate was $100 million in the third quarter and $80 million in the fourth quarter. It will be in the range of $40 million during the first quarter and they will continue to reduce that.

“By pivoting the model to an affiliate-based model, it allows us to pay for performance and directly measure (return on investment) on that customer, as opposed to spending a lot up front with the expectation of earning that over the lifetime value of the customer,” Zahn said. “It’s a more predictable and sustainable model and that’s what we’ve been focusing on for the last several months and how we will continue to manage the business through 2022.”

Board member Philip Katsaros said his previous prediction that companies’ spending to acquire sports betting customers was unsustainable has proven to be true.

Caesars Entertainment announced on its fourth-quarter earnings call in February that it was curtailing $250 million in ad spending as part of its campaign to lure sports bettors. That came after the launch in New York.

“I was on the record that this was insane,” Katsaros said without naming any companies. “The user-acquisition costs are going through the roof and I don’t see how this is sustainable. I don’t like to be proven right. We now have another company — I won’t mention their name, but they’re stepping aside in the interactive space too.”

Zahn said during the earnings calls that casino executives acknowledged the “high-degree of competitiveness and said they’re focused on rationalizing and reducing that spend over time. I think it will take care of itself over time as the industry grows, total market share grows, and operators in the space just rationalize what they’re spending.”

The New York Post reported in January that Wynn Resorts was shopping Wynn Interactive. But Zahn said there are no plans to sell Wynn Interactive. They’re focused on maximizing shareholder value.