Historical horse racing is on the rise, with Kentucky providing a model.

For decades, slot manufacturers have adapted their technology to increase their content footprint in new markets. The first example was Class II gaming under the Indian Gaming Regulatory Act of 1988, which allowed tribes across the country to place electronic bingo machines in reservation casinos.

Those machines, of course, have undergone an evolution of technology that has made the modern versions virtually indistinguishable from traditional slot games. The pioneers of this genre had to leap regulatory and legal hurdles for years as technology transformed what had been a game of bingo in which players had to “daub” individual bingo cards just as in the live game into what the machines are today. They have the same titles and game mechanics as Class III, but follow the traditional wagering rules of bingo—which is to say, players compete against each other for a common prize pool.

More recently, a newer genre of gaming has followed a similar evolutionary path, and has developed into a new industry growth area. It was 1997 when Eric Jackson, general manager of Arkansas’ Oaklawn Park racetrack, took a novel idea to several manufacturers: Data on the results of historical horse races would be logged into computer software, and customers could bet on randomly chosen races. Players could base wagers on information stored on the anonymous races—handicapping information taken from the Daily Racing Form, such as winning percentages of jockey and trainers.

Players would use this handicapping information to pick winners of three randomly chosen historical races. Wagers would be separated into betting pools for different winning possibilities, such as picking the winner of the race, picking the top three finishers in exact order, or any of the three selections finishing first and second. After placing the wager and pressing the spin button, video or an animated re-enactment of the selected past race or the race finish would be displayed on the screen.

After Arkansas legalized what was then known as “instant racing,” other states followed suit—notably Kentucky, where the venerable Churchill Downs, Inc. led a push to legalize the games to benefit the state’s flagship industry.

Just as with Class II gaming, what is now known as historical horse racing (HHR) machines or historical racing machines (HRM) have undergone a technological evolution that has generated controversy, court challenges and legislative battles, as manufacturers have transformed the games into virtual replicas of casino slot machines.

An “auto cap” feature relieves the player of having to learn handicapping by picking the horses with the highest odds on the player’s behalf. The video or animation showing the race shrunk into a tiny box at the top of the monitor or on the top box. The various prizes of the parimutuel pool are displayed as slot-machine wins.

Recently, traditional slot manufacturers have gotten into the game, porting their content and hardware into HHR versions of many of the most popular casino slot games. Ainsworth Game Technology has made the biggest splash, developing a proprietary HHR platform and signing a deal with CDI that resulted in the slot-maker’s largest-ever single order—nearly 1,000 machines to populate the operator’s Derby City gaming parlor, opened in 2018 near the site of the former Louisville Downs harness track, around five miles from Churchill Downs.

“Churchill Downs made a concerted effort not just with us, but looking at other manufacturers to develop a system that would produce a product that would be competitive with Class III product in nearby jurisdictions,” said Deron Hunsberger, chief commercial officer for Ainsworth Game Technology. “We reached an agreement with them and we collaborated with Churchill on what their vision was for an HHR system, and the type of products that they’d be able to offer.”

Ainsworth was able to rapidly develop its HHR platform by using the central determinant system it inherited with its 2016 acquisition of Class II manufacturer Nova Technologies. “We were able to use that central determinant backbone to develop a system that utilized a different database to determine game outcomes,” Hunsberger said.

“Our vice president of technology, Dave Waters, was instrumental in getting that done, and he was the genius behind working with Churchill on what those requirements would be and how the games would look. And it gave us an opportunity to develop a product that is, if not identical, very close to identical to the product that we offer in Class III environments.”

Those machines still follow the rules of parimutuel wagering, he added. For instance, since it’s illegal to win less than your wager on the parimutuel side, the Ainsworth system splits the bet between races, so small wins can occur that mimic traditional low-denomination multi-line slot games.

There are now six HHR venues in Kentucky, generating millions to support the state’s storied horse racing industry. Ainsworth has around 2,000 games live in the market.

There are now six HHR venues in Kentucky, generating millions to support the state’s storied horse racing industry. Ainsworth has around 2,000 games live in the market.

Other major slot manufacturers are now getting into the HHR game. Ainsworth created a development kit allowing other manufacturers to use its HHR platform to place their games and cabinets on the Ainsworth system, and so far, partnerships with IGT, Scientific Games, Konami and Aristocrat are bringing games from those manufacturers to venues in Kentucky and elsewhere.

AGS also has entered the HHR business, forging a partnership this year with Exacta Systems to use the Exacta platform to place its games in Kentucky, Virginia and Wyoming.

According to Hunsberger, Churchill Downs was the driver of the effort to bring in a diverse range of slot manufacturers into the HHR space, to make its Louisville facility competitive with Class III casinos just across the Ohio River in Indiana.

“They felt it was vital that they are able to offer a diversity of product on their floor,” Hunsberger said. “(The other slot suppliers) use our system to determine game outcomes, but the development is 100 percent on their end, and it’s up to them to get the games to mimic or play as closely to their Class III product as possible.”

He adds that the other benefit is a diversity of cabinet styles. “We wanted a competitive offering for our customer,” he said. “Now, they can offer IGT cabinets with IGT content. Traditionally, we’ve seen that in some Class II and VLT markets in which (only) content was licensed, there may be Ainsworth content on a Bally cabinet. We were looking for an opportunity to offer the full gambit and be able to have diversity on the floor, to provide an environment that a casino player would be used to.”

“IGT had monitored the HHR segment for more than a decade,” said Nick Khin, IGT’s chief operating officer, gaming. “It was not until about 2018, however, when we saw the segment gain momentum and mindshare with players and policymakers, that we started to act upon our segment-entry strategy. Also, as the segment grew, operators knew that they had to diversify their gaming floor, and not including IGT games in this diversification would have been a missed opportunity.”

“We began to look seriously at HHR in early 2019,” commented Tom Jingoli, executive vice president and chief operating officer of Konami Gaming, Inc. “With the anticipated expansion in this area of gaming, we knew it could present an excellent opportunity to broaden Konami’s product reach and offering. As to the R&D investment, we expanded our team to include leaders and experts with demonstrated knowledge on central servers and the nature of the sector, which provided a high degree of speed and confidence to Konami’s HHR market entry.”

Sony Syamala, Aristocrat VP Commercial Strategy Game Sales

“Aristocrat has been investigating the HHR market for a few years, and we recently decided that the market, and the technology, is matured enough for us to invest,” said Sony Syamala, Aristocrat vice president of commercial strategy and game sales. “Aristocrat is always committed to entering matured markets and providing games that elevate the player experience and quality expectations.”

“AGS had been exploring the historical horse racing market for several years but made the decision in 2020 to enter the market,” said Adam Whitehurst, senior vice president of slot sales at AGS. “To enter this exciting new market, we had to update our platform to interface with a system that provided outcomes to historical horse races.”

Bringing the best

The slot suppliers are finding their top-performing titles from the Class III market are just as successful in their HHR versions.

Hunsberger said that is definitely true for Ainsworth. “Our Quick Spin series has done very well,” he said. “Our high-denom Eagle Bucks, Cannon Ball Reloaded, Ming Warrior… Our traditional high-performing high-denom product has done very well in the market, and our traditional low-denom product has done well in HHR.” Ainsworth is introducing its new A-STAR cabinet to the HHR market as well.

He added that some games, like Altazar, have done so well in HHR venues like Derby City, Ellis Park and Red Mile in Kentucky that it has led the company to consider re-introducing it to Class III markets.

Other current HHR suppliers report similar results. “We’ve found that many of our top-performing HHR games are the same titles that excel in the traditional casino environment,” said IGT’s Khin. “For example, Fortune Coin, Fortune Charm and Wheel of Fortune Cash Link are all proven-performer titles that drive play in Class III environments and are also highly successful HHR deployments.”

Other current HHR suppliers report similar results. “We’ve found that many of our top-performing HHR games are the same titles that excel in the traditional casino environment,” said IGT’s Khin. “For example, Fortune Coin, Fortune Charm and Wheel of Fortune Cash Link are all proven-performer titles that drive play in Class III environments and are also highly successful HHR deployments.”

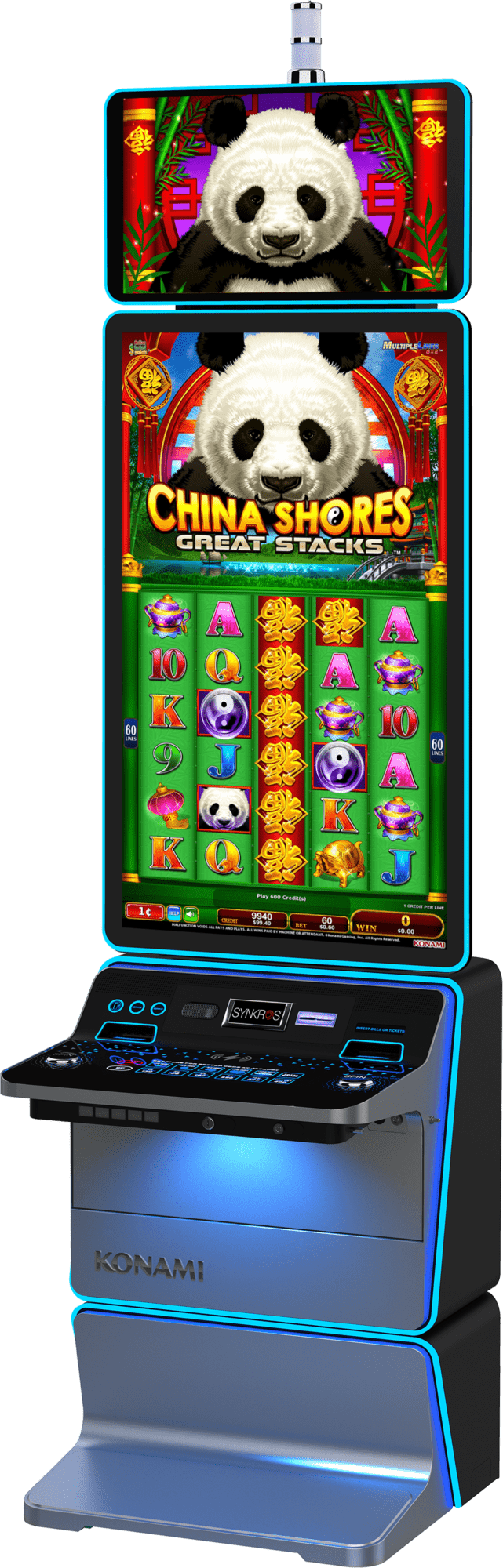

“Konami’s brand new Dimension cabinets are the primary focus (for HHR),” said Jingoli. “The Dimension 49, with its large portrait display and 27-inch topper, really stands out on the floor. Content such as China Shores Great Stacks, with its popular 2X pay free games, and our highly successful Diamond Trails series, with progressives and the chance to win four jackpots at the same time, really catch player attention.”

“Konami’s brand new Dimension cabinets are the primary focus (for HHR),” said Jingoli. “The Dimension 49, with its large portrait display and 27-inch topper, really stands out on the floor. Content such as China Shores Great Stacks, with its popular 2X pay free games, and our highly successful Diamond Trails series, with progressives and the chance to win four jackpots at the same time, really catch player attention.”

“Our Orion Portrait cabinet is the top-performing cabinet in the HHR markets that we have already entered,” said Steve Walther, AGS vice president of product management, slots. “It features a unique gaming experience to players with its attractive emotive lighting design containing a ring of 498 game-controlled, game-synchronized LED lights and 42-inch HD touchscreen. Later this year, we’ll introduce our Orion Curve into HHR markets and feel it will be as successful as our HHR Orion Portrait games.” He said top performers in HHR are games in the Imperial 88 series, Peacock Beauty and Tiger Lord.

For Aristocrat, top traditional hits like Buffalo, Timber Wolf, Fu Dia Lian Lian and Gold Stacks 88 will lead the way. “Aristocrat will bring out two market-leading portrait cabinets, the Helix XT and the MarsX Portrait, along with the top-performing MarsX Dual Screen cabinet,” said Syamala. “These cabinets will have the best-performing Aristocrat Class III content ported over to HHR to run on them.”

The HHR market is in expansion mode in several states. According to Ainsworth’s Hunsberger, the Kentucky market is continuing to grow. “There are multiple development projects in different phases with Churchill and other current operators in the market,” he said. “There will continue to be growth and expansion in Kentucky.”

Ainsworth was recently approved in Wyoming, and is expected to go live there in August. “That is similar to a distributed gaming model,” Hunsberger said. “The locations are primarily OTBs, with 50 to 100 machines and just a little bit different facility layout than what you see in Kentucky. We’re in one property in Alabama, in Birmingham, and there’s potential for some expansion in that market… And then we are in Virginia in one location.” That location is Colonial Downs, which had been shuttered five years when it reopened in 2019 with HHR machines in Rosie’s Gaming Emporium.

New Hampshire passed HHR legislation only weeks ago, for HHR machines in 17 casinos dedicated to charity gaming, and Louisiana just passed legislation to allow HHR in OTB facilities.

Tom Jingoli, Executive VP and COO of Konami Gaming, Inc.

IGT currently has HHR deployments in Kentucky, Virginia and Wyoming, with the highest concentration in Kentucky. Konami is in the Kentucky market, having launched this spring. “We are also looking at additional markets in the United States,” said Jingoli. “The growth for HHR is rapid, and Konami intends to be a player in that expansion.”

HHR is growing as a means of generating additional tax revenue, and preserving horse racing in states like Kentucky. “Kentucky’s a little bit different animal because horse racing is such a large part of their economy,” said Hunsberger, “not just funding purses, but also, breeding and other ancillary economic benefits based off of horse racing in that market. So, it was very important for them to be able to have something that supported that piece of their economy.”

“Horse racing is an honored tradition that goes back to the 17th century in the United States,” said Konami’s Jingoli. “To utilize HHR as an opportunity to fund these purses and hold that tradition makes complete sense.”

Adds Syamala, “Aristocrat absolutely feels that what has been achieved as a major success in Kentucky for the revered horse industry in that state will be a model for other states to adopt to help ensure a strong future for their horse racing industry.”

“Other states are also considering HHR, so new markets are on the horizon,” said AGS’ Whitehurst. “We feel that other states will look at how HHR can offer casino-style gaming through a historical horse racing outcome and seriously look at bringing the same kind of excitement and revenue potential to their markets.”