If you look at the Eiler’s “Gaming Suppliers KPI” report of the second quarter of 2021, all the slot machine manufacturers are doing great, recording record revenue numbers, with many surpassing 2019 results.

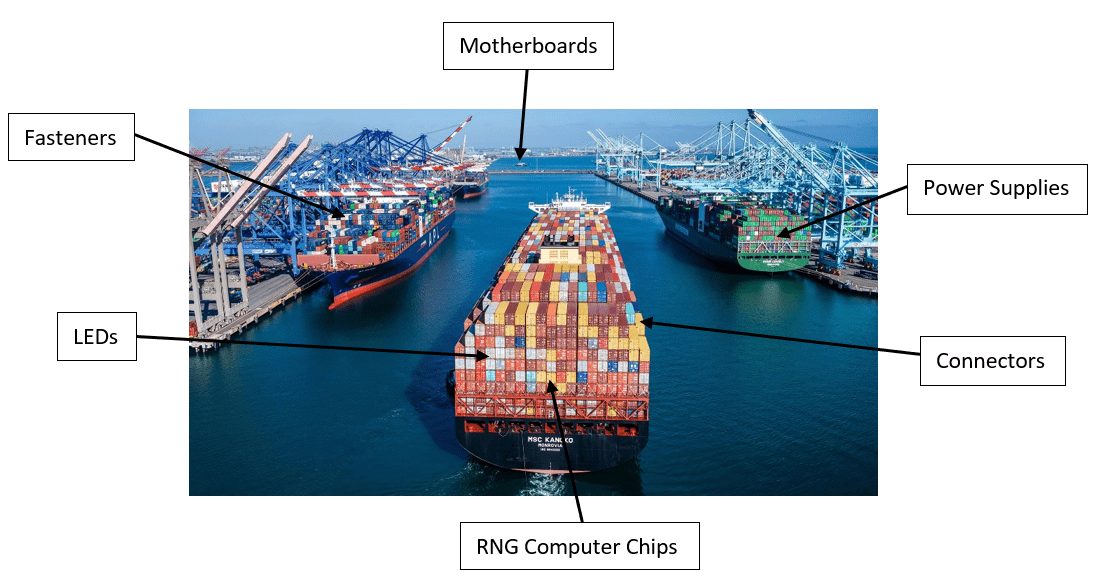

But then you turn on the nightly news and see photos like the one below, except that hundreds of ships are not even able to get that far into port. They are stuck at anchor waiting for an open dock, stevedores to unload them, and truck drivers able to move the goods out. That’s not to mention the pent-up demand for everything and an overall labor shortage everywhere. In case you were unaware, everything arrives by boat to the U.S. these days (including many “authentic” Native American arts and crafts).

Somewhere out in the harbors of Long Beach and L.A., or just outside San Francisco Bay, are ships full of cars, electronics, slot machine parts and toys. The good news is … well, there isn’t any good news. If little companies like General Motors, Ford and Chrysler can’t get microchips for their cars and trucks, how are slot machine makers coping …. really?

The reports are mixed. First, remember that the numbers quoted by Eilers about suppliers include Gaming Ops revenues. Those are booming and match with the huge gaming revenue increases reported by individual casinos post-COVID for the last several months. However, in terms of shipments of games, Eilers estimates that many companies could report a 30% decline from pre-COVID levels.

With record strong gaming revenues at the properties now for the third and fourth quarter, demand for new games will most certainly be peaking. And that could cause supply problems regardless of the shipping backlogs.

How long will this last? According to the New York Times, “No one really knows, but there are good reasons to suspect that this will be with us well into 2022 and maybe longer. Shortages and delays are likely to affect this year’s Christmas and holiday shopping season by making it much harder to find key goods. A lot of companies ordered earlier, which is exacerbating the shortages, sending more surges of goods toward ports and warehouses.”

Likewise, Forbes noted more bad news, saying, “The average price for a Chinese-made standard 40’ container is approaching $6,000, more than double what it was in 2016. The post-lockdown jump in demand, combined with lower container turnover, caused prices to rocket higher.”

The Biden administration has ordered 24-shifts for stevedores on the docks to help unload ships, but that leads to other problems. Containers are now sitting unclaimed onshore, backing up the ports even more.

Again, from Forbes, “Thousands of containers are still stuck in the wrong place. According to driver recruiting firms, there is one qualified driver for every nine job postings. The trucking industry is very fragmented, with the bulk of drivers working at small firms. 89% of trucking companies have one to five trucks. With the average price for a Class 8 truck at $59,377 in July compared with $40,666 a year earlier, margins are heading lower, making it even less attractive for independent contractors to enter the industry.”

What does all this bad news mean for your G2E order of new machines? The messages are mixed and unclear.

Some are very realistic and urge patience. “Like so many other companies, IGT is certainly impacted by the global supply chain issues. They have touched many parts of our business, but hardware delivery is particularly impacted, and I believe it will stay this way for several more months,” says Nick Khin, COO. “Much of it is out of our immediate control, however we are doing all that we can to communicate transparently with our customers, manage expectations and strategically allocate available resources.

“In addition to supply issues related to various slot machine components, we are also impacted by the very well-publicized shipping and transportation challenges experienced by many industries. We are asking our customers to provide us as much notice as possible on their purchasing intentions so we can plan accordingly and strive to meet expectations. The majority of the orders and opportunities that IGT received at G2E were for 2022 deliveries.”

Just slightly less forthright, Scientific Games says, “The gaming industry, like many industries around the globe, is navigating through an unprecedented supply chain environment. Scientific Games has a talented team of experts leading our supply chain strategy and response program, which remains dynamic. We are excited to see such a strong recovery in our industry and demand for SG’s products and services. Our talented teams remain agile and continue to explore all opportunities to ensure we deliver our market-leading products on time to our customers.”

A few suppliers feel they may be positioned better for the short term. “For Novomatic, it is less of a hit as we manufacture our own boards, cabinets, cables and more. We’ve stocked up to a level of at least 12 months of manufacturing, so we are in a much better state than most,” says Rick Meitzler, U.S. CEO. “Shipping will slow all of the overseas manufacturers some, as getting containers and a scheduled ship to bring them over to the U.S., but this is a little less of a slowdown unless you ship into the west coast.”

Others just don’t want to talk about it at all. Aristocrat chose not to respond to our queries. It’s hard to blame them, simply because even those who did respond are probably optimistically guessing, like the rest of us, as to what the future may hold.

As the Atlantic said in their October issue, “So the world is getting a lesson in Econ 101: High demand plus limited supply equals prices spiraling to the moon. Before the pandemic, reserving a container that holds roughly 35,000 books cost $2,500. Now it costs $25,000.”

Jason Weller, Director of Operations and Field Services at Gaming Arts agrees, “We have seen a dramatic increase in inbound and outbound shipping costs, from larger invoices for inbound shipments and higher rates for outbound deliveries. There are also more delays being seen for shipments due to the shortage of transportation options available, as many companies are seeing a shortage of drivers for domestic deliveries and immense slowdowns for international deliveries due to port congestion and delays in customs clearance.”

Paul J. Enos, CEO of Nevada Trucking Association, said, “The reality is, trucking companies, we’re already working 24-7. We’re seeing a huge demand with limited capacity, limited truck drivers, and we’re also having an issue getting parts for trucks.”

Almost everyone contacted noted that this is a problem faced by every industry, with just slightly more concern for us. “Slot machines may be impacted at a different degree than some other industries due to the uniqueness of the industry itself,” Weller says, “Most other companies have many aftermarket choices for replacement parts on standard items, whereas the parts a slot manufacturer uses may not work with any other manufacturers’ games. Component-wise, the machines are similar; however, each has its own customized items that can be harder to source, especially if there are only one or two companies that supply the parts.”

One correction to the earlier statement: there is some good news. The lumber shortage has eased. Unfortunately, not that many slot machine RNG chips are made of wood these days.

It’s enough to drive you to drink. But before you do, note that CBS News reports, the supply chain situation has not been kind to an industry that relies heavily on imported beverages. “Clearly, right now there’s a shortage of containers (bottles),” says the Distilled Spirits Council’s David Ozgo. Brown-Forman, the maker of Jack Daniel’s and Woodford Reserve, said recently its distributor and retail inventories have become reduced due to a mix of transportation and logistics disruptions. All of which are reportedly impacting inventory levels for many drinks across the U.S. and abroad. OMG!