As cashless payment companies search for an edge in a competitive marketplace, the pace of innovation is breathtaking. There are multiple options for gaming operators to consider providing to patrons who would like to gamble in the same way they buy groceries, clothing or lattes at coffee shops.

Global Payments Gaming Solutions’ latest innovation unlocks one of the barriers to more widespread adoption of cashless gaming. Two operators – Circa Sports Colorado and Action 24/7 – recently adopted the company’s online banking solution technology that provides a more seamless and frictionless gaming experience.

Notably, Global Payments features an option where patrons can enter their bank information manually or use online banking credentials, allowing for faster and easier enrollment.

“This aspect of our product is a new addition to our services,” says Global Payments President Christopher Justice. “This new feature is designed to make the iGaming experience as frictionless as possible.”

The system makes it easier for customers to join the VIP Preferred e-check network that electronically transfers funds directly between VIP Preferred and customers’ bank accounts. Global Payments uses online banking credentials to digitally register for online payments.

Justice says Global Payments uses “automated approval technology and bank-grade security to both protect the casino’s liability and the patron’s information. This new integration also mitigates risk by automating much of the process.”

A hurdle to the implementation of cashless payment solutions has been the time it takes to enroll in a program. But Global Payments’ latest innovation creates a more streamlined and faster onboarding process.

“Patrons at participating casinos can upload their banking credentials and get approved almost instantly,” Justice says. “This enrollment process can also take place anywhere, and at any time.”

The need for cashless payment options is undoubtedly going to increase, as sports betting and igaming spread throughout the country.

Because jurisdictions have unique banking and gaming requirements, Global Payments adjusts its services in order to ensure regulatory approval.

“Gaming industry regulations are notoriously rigorous,” Justice says, “so we needed to be very careful in developing something as robust as online banking credentials for gaming. We work to ensure that our solutions meet all regulatory requirements in the states where our casino partners operate.

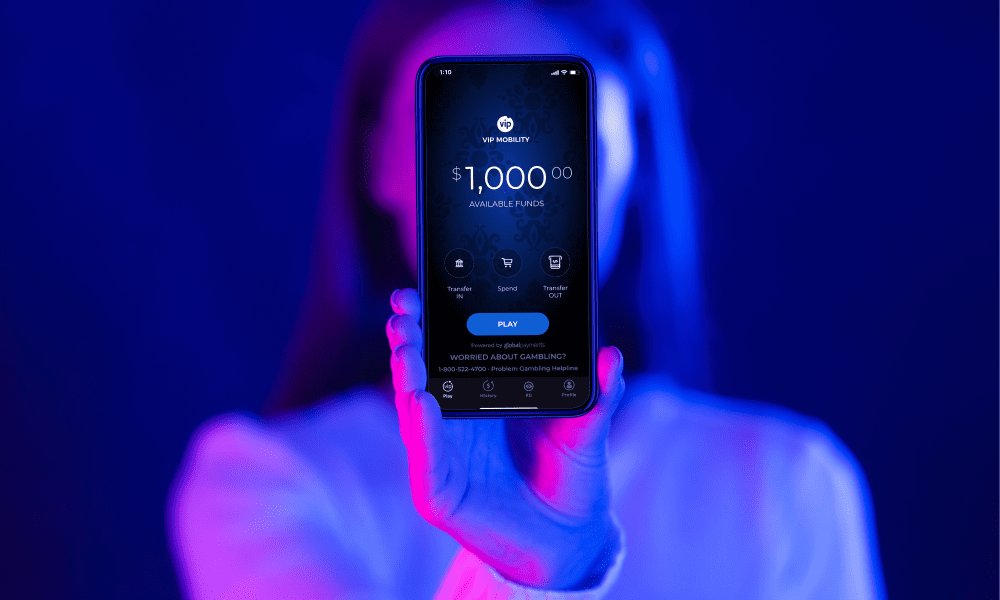

Global Payments’ online banking solution joins a suite of innovations – including VIP Lightspeed for casino cages, VIP Mobility for cashless gaming, and VIP Shield for compliance, and anti-money laundering and IRS reporting – that are meeting the demands of the gaming industry. At the recent Global Gaming Expo in Las Vegas, the products drew interest from a variety of customers.

“Our booth attendees were very excited to get a hands-on experience with our products,” Justice says, “and they were thrilled by how intuitive they were to use and implement.”