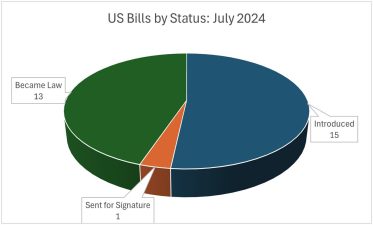

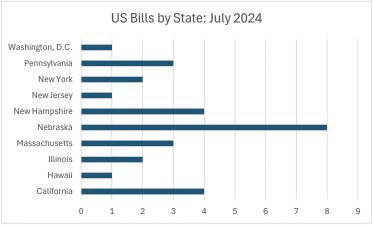

The state legislatures in 9 states and the District of Columbia have processed a total of 29 gambling-related bills that went through the various stages of the lawmaking process during July 2024. As of this date, there are five US state legislatures (10%) in session with six states in recess.1 Out of the many bills our system processed during the month of July, this report will review some of the most important laws that were recently introduced or became law.2

Win, Lose, or Draw: Legislation that Became Law

Win, Lose, or Draw: Legislation that Became Law

Bingo:

California – SB 1044 is an Act that amends Section 326.5 of the California Penal Code specifically relating to bingo games. The existing law allows cities and counties to regulate bingo games for charitable purposes. The proceeds from these games must be kept in a separate fund and used only for charitable purposes, with certain exceptions. This Act increases the monthly limit on bingo overhead costs to $3,000 per month, starting from January 1, 2025, and increases annually based on the California Consumer Price Index for All Urban Consumers. The Act also includes provisions regarding the conduct of bingo games, the use of funds, licensing fees, and the use of card-minding devices. Note: SB 1044 (7/15/2024) Became Law, Chapter 128, Statutes of 2024.

Charitable Gaming – Raffles:

California – SB 1525 amends Section 320.6 of the California Penal Code. This section outlines requirements for conducting raffles by eligible nonprofit organizations affiliated with major sports leagues. The Act specifies rules and regulations for raffle tickets and winners that must be drawn manually without the use of random number generators or gaming machines. Also mentioned in the Act are specifications for gross receipts from ticket sales and raffle operations that must be supervised by registered individuals over 18 years old affiliated with the conducting organization. Furthermore, tickets cannot be sold for cryptocurrency, and raffles cannot occur at gambling establishments or be conducted over the internet. Note: SB 1525 (7/2/2024) Became Law, Chapter 80, Statutes of 2024.

Gambling Offenses:

Hawaii – This Act amended the definition of ‘advance gambling activity’ in the Revised Statutes of Hawaii. The amendment removes language that includes “making no effort to prevent the occurrence or continuation of gambling activity.” The bill does not affect rights and duties that were already established or ongoing proceedings. It is part of the Honolulu Prosecuting Attorney Package and is focused on the penal code and gambling. The bill will take effect upon approval, but it will be repealed and the original section 712-1220 of the Hawaii Revised Statutes will be reenacted on July 1, 2029. Note: SB 2197 (7/9/2024) Became Law, Act 249.

Games of Chance:

New Hampshire – HB1549 is an Act that relates to buy-in amount deductions collected during the operation of games of chance. The bill amends New Hampshire Rev. Stat. 287-D:14, XVI to change the deduction from the buy-in amount collected from players of games of chance where chips have no monetary face value. Under the new law, a minimum of 20 percent or $250 of the buy-in amount collected from players, whichever is less, shall be deducted from the buy-in amount. Of the total amount deducted, 35 percent is paid to the charity, and the balance is retained by the game operator employer. Additionally, the Act allows game operator employers to offer players the option of a dealer add-on, where the player receives additional chips in exchange for paying an additional sum. The dealer add-on cannot exceed $25, and 100 percent of the add-on is given to dealers as a gratuity. The bill will take effect on September 17, 2024. Note: HB 1549 (7/26/2024) Became Law.

Licensing:

California – SB 1519 is an Act that amends Sections 19859, 19878, 19879, 19882, and 19892 of the California Business and Professions Code. The Act relates to gambling and addresses various aspects of licensing and regulation. It allows the California Gambling Control Commission to not apply certain provisions to individuals whose license was denied solely due to their failure to clearly establish eligibility and qualification for licensure. It also clarifies that an applicant with an out-of-state conviction for a misdemeanor involving dishonesty or moral turpitude may be considered for licensure if the conviction has been expunged under the laws of the state where the conviction occurred. Note: SB 1519 (7/15/2024) Became Law, Chapter 138, Statutes of 2024.

Lottery:

New Hampshire – SB324 relates to lottery license renewal notices in the state of New Hampshire. It requires the lottery commission to notify Lucky 7 licensees when their license expires or is revoked. The bill also amends New Hampshire Rev. Stat. 287-E:19, II to specify that applications for license renewal should be received by the commission 15 days prior to expiration, unless waived for good cause. Additionally, the bill amends New Hampshire Rev. Stat. 287-E:25 to outline the suspension and revocation process for licensees who violate the provisions of the subdivision. The effective date of the bill is January 1, 2025. Note: SB 324 (7/30/2024) Became Law.

Racing:

New Hampshire

SB 473-FN is an Act that governs the process for and designation of unclaimed horse racing tickets and voucher money and amends New Hampshire Rev. Stat. 284:31. Under the new law, every person, association, or corporation conducting a race or race meet must pay to the state treasurer all money collected from pari-mutuel pool tickets and vouchers that have not been redeemed. The state treasurer is responsible for paying the amount due on any ticket or voucher to the holder from funds not otherwise appropriated, upon an order from the lottery commission. Pari-mutuel tickets and vouchers that remain unclaimed after 12 months will not be paid. Additionally, the person, association, or corporation must submit a check for any unclaimed money during the previous fiscal year, along with a gaming operator’s written report that itemizes the unclaimed tickets and vouchers and the unclaimed amounts. This report must be submitted to the treasurer by July 1 of every year, and a copy must be forwarded to the lottery commission. The act will take effect 60 days after its passage, with an effective date of September 24, 2024. Note: SB 473-FN (7/30/2024) Became Law.

HB 1525 is an Act relating to historic horse racing game operator employer licensing and amends New Hampshire Rev. Stat. 284:22-b, II, which governs the eligibility for licensed facilities to sell pari-mutuel pools on historic horse races. The Act states that a game operator employer licensed after July 1, 2024, may sell pari-mutuel pools on historic horse races if their application was received by the lottery commission prior to October 18, 2023, and was deemed eligible for a game operator employer license. The sales must be within the enclosure of the licensed facility. The bill also specifies that a license for offering wagers on historic horse races cannot be transferred or sold. Additionally, the Act repeals New Hampshire Rev. Stat. 2021, 66:10, which relates to licensed historic horse racing facilities, and New Hampshire Rev. Stat. 2021, 66:11, I, which relates to effective dates. Note: HB 1525-FN (7/26/2024) Became Law.

Tribal Gaming:

California – AB 1935 adds Section 12012.91 to the California Government Code. The purpose of this Act is to suspend the payment or collection of any quarterly payments required to be made by gaming tribes to the Indian Gaming Special Distribution Fund for the period from July 1, 2023, to June 30, 2025. Additionally, the California Gambling Control Commission is required to refund any quarterly payment already made by a tribe during that time period. The Act defines “tribe” as a federally recognized tribe conducting gaming operations in California under a tribal-state class III gaming compact or procedures issued by the Secretary of the United States Department of the Interior. The Act is deemed necessary for the immediate preservation of public peace, health, or safety, and therefore, it goes into immediate effect. Note: AB 1935 (7/15/2024) Became Law, Chapter 93, Statutes of 2024.

New Players to the Game: Recently Introduced Legislation

Casino:

Pennsylvania – This bill is known as the Local Option Small Games of Chance Act that amends the Act of December 19, 1988. It provides for the authorization and regulation of non-banking games conducted by certificate holders. The document outlines the scope of the chapter, definitions of key terms, and the authority and duties of the Pennsylvania Gaming Control Board. It also covers preliminary provisions, general procedures, authorization, operations, fees and taxes, and miscellaneous provisions related to non-banking games. The document specifies that certificate holders must conspicuously display handouts and materials related to responsible gaming, post signs regarding gambling problem helplines, and participate in a mandatory training program. Failure to comply with these requirements may result in administrative penalties and the suspension of the certificate holder’s non-banking game operation certificate. The taxes imposed on certificate holders are based on their daily gross non-banking game revenue. Note: HB 2520 (7/30/2024) Introduced.

Fantasy:

Nebraska – LB6 is a legislative bill to amend existing gaming laws and adopt the Fantasy Contests Act. It redefines terms related to fantasy contests and provides a gambling exception for conducting or participating in such contests. The bill also addresses the possession of gambling records and establishes registration requirements for fantasy contest operators. It outlines the procedures for registration, renewal fees, and the remittance of fees to the State Treasurer. The bill also sets forth conditions for fantasy contest operators, such as preventing employees from participating as players, prohibiting the sharing of confidential information, and verifying the age of players. It requires fantasy contest operators to contract with a certified public accountant for an independent financial audit and imposes civil penalties for violations of the Fantasy Contests Act. The bill does not apply to pari-mutuel wagering on horse races, authorized games of chance within licensed racetrack enclosures, or certain types of lotteries, bingo, raffles, and gift enterprises conducted in accordance with other specific acts. Note: LB 6 (7/25/2024) Introduced; Public Hearing held on July 31, 2024.

Gaming Tax:

Nebraska

LR 23CA is a proposed constitutional amendment to require the Legislature to authorize, regulate, and provide for the taxation of gambling activities. The amendment also designates how the tax proceeds from such gambling activities should be used. The proposed amendment includes provisions for various forms of gambling, including games of chance, lotteries, bingo games, sports wagering, and wagering on horse races. It also addresses the conduct of gambling activities through online or mobile platforms, specifying that such activities must be conducted by individuals or entities with a physical location in Nebraska. The proposed amendment also allows for the establishment of a state lottery and the regulation of other lotteries, raffles, and gift enterprises for charitable or community betterment purposes. The proposed amendment also includes provisions for the licensing and regulation of wagering on horse races and bingo games conducted by nonprofit associations. The document concludes by stating that the proposed amendment will be submitted to the electors for approval or rejection in the general election in November 2024. Note: LR 23CA (7/29/2024) Introduced; Public Hearing held on July 31, 2024.

LB16 is a legislative bill relating to revenue and taxation by amending various tax provisions and adopting the Nebraska EPIC Option Consumption Tax Act. The bill seeks to terminate the Nebraska Budget Act, tax-increment financing, the motor vehicle tax, the motor vehicle fee, the property tax, the inheritance tax, sales and use taxes, the income tax, the homestead exemption, the Tax Equity and Educational Opportunities Support Act, and the Community College Aid Act. The bill also proposes changes to the ImagiNE Nebraska Act. Specific language in Sec. 23 of this Act relates to taxable gaming services of a gaming sponsor that will be subject to the consumption tax. Note: LB 16 (7/25/2024) Introduced; Public Hearing held on July 31, 2024.

Responsible Gaming:

Pennsylvania – HB 2518 is a bill to amend Penn. Cons. Stat., Title 4 (Amusements), specifically in relation to the Pennsylvania Gaming Control Board’s regulatory authority. The bill proposes the adoption and promulgation of regulations to establish mechanisms that allow players to set limits on the amount of money wagered on slot machines or video gaming terminals, as well as the amount of money lost during specified time periods. Note: HB 2518 (7/30/2024) Introduced.

Sports Wagering:

Nebraska

LB32 is a legislative bill to redefine terms related to sports wagering under the Nebraska Racetrack Gaming Act. It specifically seeks to amend section 9-1103 of the Neb. Rev. Stat Supplement, 2023, which defines various terms related to sports wagering and deletes specific language related to college sports. Note: LB 32 (7/26/2024) Introduced; Public Hearing held on July 31, 2024.

LR3CA is a proposed constitutional amendment to permit authorized gaming operators conducting sports wagering within a licensed racetrack enclosure to allow individuals located within the state to place sports wagers through a mobile or electronic platform. The amendment specifies that the individual placing the sports wager must be located inside Nebraska at the time the wager is placed. The proposed amendment will be submitted to the electors of Nebraska for approval or rejection in the general election in November 2024. Note: LR 3CA (7/25/2024) Introduced; Public Hearing held on July 31, 2024.

LB13 is a legislative bill to amend sections of the Nebraska Racetrack Gaming Act and change the distribution of taxes collected from sports wagering. It also seeks to authorize an authorized gaming operator to conduct sports wagering through an online sports wagering platform. The bill defines terms related to sports wagering, such as authorized gaming operator, authorized sporting event, collegiate sporting event, commission, game of chance, and more. It outlines the requirements and procedures for conducting sports wagering, including the use of online sports wagering platforms and the submission of controls for approval by the State Racing and Gaming Commission. The bill also addresses the distribution of tax revenue generated from sports wagering and proposes changes to the property tax credit program. Note: LB 13 (7/25/2024) Introduced; Public Hearing held on July 31, 2024.

New York – A10658 is a proposed amendment to the racing, pari-mutuel wagering, and breeding law in the State of New York. The amendment focuses on advertising restrictions for mobile sports wagering licensees. It aims to ensure that advertising is based on factual information and does not contain false, deceptive, or misleading content. The amendment specifies several requirements for advertisements, including the clear and conspicuous specification of material conditions or limiting factors, the prohibition of depicting individuals under the age of 21 engaging in gaming activities (with an exception for incidental depictions), and the inclusion of the name and location of the gaming facility conducting the advertisement. Additionally, each advertisement must prominently display a problem gambling hotline number, and direct advertisements must provide methods for individuals to opt out of receiving future direct advertisements. The amendment also mandates that gaming facility licensees, applicants, and mobile sports wagering licensees provide the commission with complete and accurate copies of all advertisements within five business days of their public dissemination. These licensees are required to maintain records of all advertisements for at least two years and make them available to the commission upon request. Note: A 10658 (7/22/2024) Introduced.

Video Gaming Terminals (VGTs):

Illinois – HB5866 is a legislative bill that makes amendments to the Video Gaming Act to allocate a portion of the tax collected from net terminal income to the South Suburban Property Tax Relief Fund, starting from January 1, 2025, until December 31, 2029. Note: HB 5866 (7/24/2024) Introduced.

1Regology database statistics filtered by jurisdiction [US federal/50 states], status [applicable bills only], and time period [July 1 – 31, 2024].

2Bills included in this category are reported “active”, even though the state legislature may have adjourned during this time period. Regology uses the official status reported by each individual state legislature according to their policies and procedures.