It seems like barely a week goes by where U.S. sports betting headlines are not dominated by negative news coverage. From the spread of gambling advertising to regulators being criticized to wagering skulduggery by professional athletes, or states increasing taxes on operators, wherever one turns, the bad news stories keep on appearing.

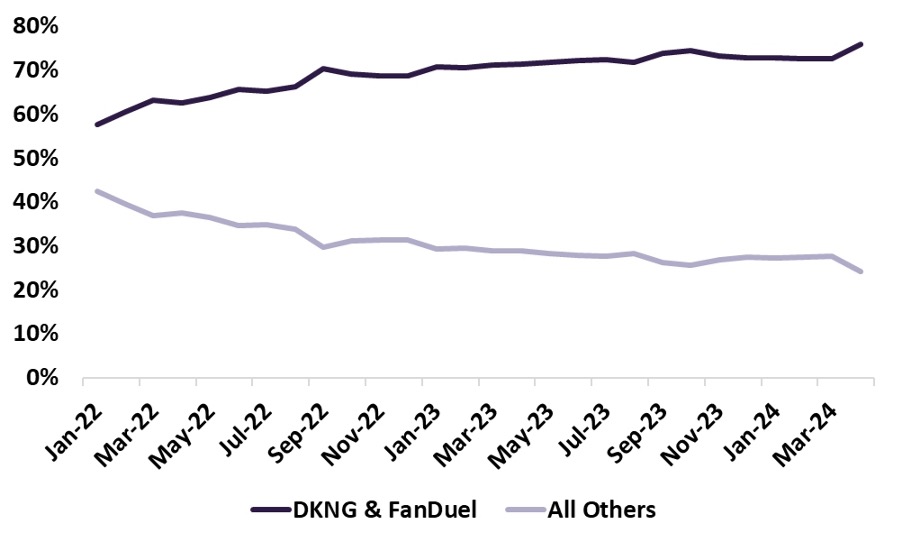

Just as the online sports betting industry in the U.S. seems to be caught up in a doom loop of bad news and negative trends, its two leading brands continue to pull away from their competitors with unerring ease.

Indeed, while coverage of the industry is dominated by bad press, the big two digital players, DraftKings and FanDuel, continue to dominate all that they survey. Bad news for the betting brands trying to catch up with them, the rest of the field is running (hard) just to stand still, never mind actually getting near to becoming meaningful rivals to the two market leaders.

This point was once again emphasized by the analyst team at Truist Securities. In a recent note laying out their views on the industry’s current state of play, the Truist team highlighted how dominant those two brands have become.

Leading the charge

Running through the different industry players trying to make further inroads into this space, Truist said the current environment is “the legacy DFS operators’ world until proven otherwise” as both groups “continue to lead the rest of the pack”.

The analysts highlighted the fact that both operators increased their lead, albeit “modestly”, over the rest of the field in 2024 and, when combined, account for 73% of handle share from January to April this year, with FanDuel continuing to lead with 38% share of handle against DraftKings’ 36%.

Chart 1: Gross Handle Share (%) – DKNG & FanDuel (Combined) vs. All Other Operators

Source: Truist Securities Research, state gaming commissions. States include: IN, IA, PA, IL, MI, AZ, NY, KS, MD, OH, WY, MA & KY.

More worrying for the other books is their ongoing inability to compete in any meaningful way with the two leaders. As the Truist team noted, “it remains to be seen which operator can innovate to move share from here, or if either deem it necessary”.

And, while the “lower tiered operators will continue to push”, this will tend to be tech-driven, as marketing and promotional spend tend to be very expensive and uncertain in the returns they generate. But tech efficiencies take time to bed in, and product-led improvements are subject to a broad range of factors.

All the while, DraftKings and FanDuel will continue to innovate, iterate and launch new products or carry out strategic acquisitions with the aim of consolidating their positions. “These two won’t stand still,” noted the Truist team.

DraftKings meanwhile will press on with its near-term efforts to drive up its EBITDA figures. Its rumored acquisition of the live betting data specialist Simplebet is a clear statement of this intent, as it seeks to reduce the monthly royalties it pays out to third party providers by acquiring them outright.

Indeed, its takeover of SportsIQ Analytics a few weeks before was one iteration of this strategic goal and the long-mooted Simplebet deal is another example of it. The fact that both transactions are also said to have been concluded with stock payments also means no debt or credit facilities needed to be arranged and the revenues they bring will go straight to DraftKings’ bottom line.

Wide open spaces

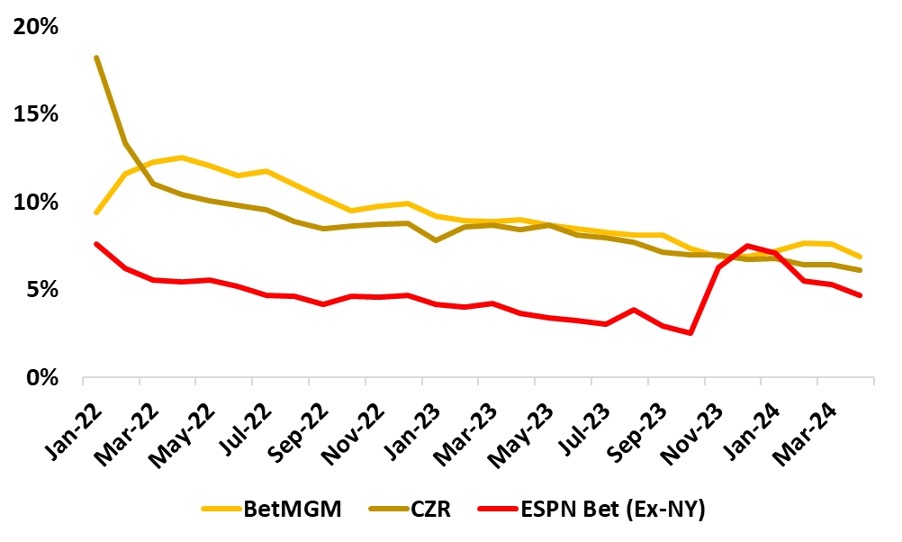

DraftKings’ and FanDuel’s immediate chasing trio of BetMGM, Caesars Interactive and ESPN Bet/Penn Entertainment meanwhile “are resigned to high single digit (market) share territory for the bulk of 2023”, and likely 2024, and, unless something truly dramatic happens, the next few years.

But tellingly, Truist also pointed out that it skipped a “tier two” category, because “we don’t think any operator in the space qualifies for that standing” within “the white space” that currently exists between DraftKings, FanDuel and those betting brands. “We’ll watch ESPN Bet and their new tech closely this fall to see if they qualify for a jump up in class,” added the Truist team.

Chart 2: Gross Handle Share (%) – BetMGM, CZR & ESPN Bet (Ex-NY)

Source: Truist Securities Research, state gaming commissions. States include: IN, IA, PA, IL, MI, AZ, NY, KS, MD, OH, WY, MA & KY. Note: ESPN Bet share is reflected not including NY, given they aren’t yet live in the state.

Pressure is on

The graph above illustrates how those groups’ market shares have evolved, or rather regressed, over the past 24 months. And leaving out ESPN Bet’s short-lived jump to 10% share following its November 2023 launch, Caesars’ and BetMGM’s market share drops are striking, while the pressure remains on them to hit $500m in EBITDA by 2025 and 2026 respectively, and ESPN Bet is expected to be “meaningfully profitable” by 2026.

In its note Truist described Bet365, Fanatics and Rush Street Interactive as its ‘tier four’ operators; and while the first two had some “success on a relative basis in states where they are live”, it is difficult to get insights into how they will fare. Rush Street however has carved out a space for itself in the U.S. landscape by focusing on online casino, its ‘home state’ of Illinois and some canny B2B moves in Mexico and Colombia and is a strong contender as an acquisition target.

Taxes only going one way

Finally, while the Illinois tax rise augurs unfavorably for the industry and other states will surely look to boost their revenues, it seems more of them will follow Illinois’ move.

Tax rises are never welcome, and this will provide no comfort to operators, but for those outside the U.S., a rise from 10% to 20%, such as that seen in Ohio, still leaves operators in a much better position than many of their European counterparts. The Netherlands is an example of this, with lawmakers there looking to raise the tax on operators from 30.5% to 38.7% of GGR.

Truist said it doesn’t expect market shares to be affected in any major way in Illinois, but the smaller operators may at least be able to compete more strongly thanks to the state’s new progressive tax, while for politicians and lawmakers, raising taxes on gambling companies has never cost them politically and is likely to continue for the foreseeable future.