Hello and welcome to this week’s Igaming Focus newsletter.

On the slate this week:

- VIPs are crucial to the success – or otherwise – of operators, as this week’s DraftKings-Fanatics and New Jersey gross gaming revenue (GGR) share news demonstrates.

- Debate redux: Online-offline casino cannibalisation talk continues, as Deutsche Bank says no new icasino launches in 2024.

- Caesars CEO’s mitigating circumstances for poor Q1

- AGA survey: U.S. gaming CEOs optimistic

- News shorts: Florida, Dave& Buster, Tipico for sale

Source: Shutterstock

DraftKings wins injunction against ex-VIP boss, but importance of VIPs on GGR is clear

VIP impact on operators’ GGR share plays out in New Jersey as DraftKings and Fanatics battle it out in court.

J’accuse: The District Court of Massachusetts has issued a preliminary injunction against DraftKings’ former head of VIP operations Michael Hermalyn that prevents him from working for Fanatics Betting and Gaming. The court’s decision comes as part of a bitter dispute between the two operators, with DraftKings accusing Hermalyn of planning to steal confidential information about its VIPs and take it to Fanatics, which hired him at the start of the year.

- The importance of VIPs has been brought into sharp relief by recent data showing how Fanatics significantly boosted its market share in New Jersey by attracting high value players to its offering.

- Under the influence: A note published last week by Jefferies pointed out that DraftKings’ GGR market share for March was down 7ppts month-on-month (MoM) to 30% across 16 states and was “heavily influenced by a swing in New Jersey, where DraftKings’ share fell -17ppts MoM to 20%, while Fanatics’ share increased +13ppts to 24%”.

- The analysts added that “the swing is believed to have been driven by a small number of VIPs. Indeed, this appears reflected in the monthly volatility, with Fanatics recording GGR of $29m/$7m/$20m across the first three months of 2024”.

- High dependency: Regulus Partners commented that in common with most discretionary markets, “nearly all gambling markets are skewed to VIP users”, but the New Jersey statistics showed how much the U.S. online gambling industry depends on these players.

- The importance of VIPs was “not just a flash in the pan”, added Regulus, and was underlined by the legal dispute between the two companies, as it’s “not uncommon for online gambling businesses to generate 25-40% of revenue from the top 1% of ‘VIP’ actives, with a Pareto Curve even within that cohort”.

- Backlash: In addition, recent betting scandals and the proliferation of advertising and “ubiquitous accessibility (including often on college campus)” has led to a “public-political backlash” in the U.S. and could lead to regulatory changes that could “impact the attractiveness of the market to VIPs and regular users risks completely hollowing the market out”.

Cannibal debate redux

The topic of offline-online casino cannibalisation resurfaced during the recent East Coast Gaming Congress.

Ongoing disagreement: As executives discussed the potential for regulated online casino in the U.S. and the land-based casino licenses that operators are vying for in New York, Mark Giannantonio, CEO of Resorts Casino Hotel in Atlantic City, and Rob Norton, president of the Baltimore-based Cordish Gaming Group which operates the Live! properties in Pennsylvania and Maryland, disagreed on the impact of online gambling on land-based casinos.

- Giannantonio’s company partners with Resorts Digital Gaming, which operates the Resorts Online Casino brand, and with DraftKings for retail and online sports betting.

- He said, “for New Jersey, [online casino] has been additive”, while Norton said the current model was not exploiting digital and offline convergence as it should and the “approach is pitting ourselves against ourselves”. “We definitely see it as cannibalistic,” he added.

- Tethered connection: As companies vie to build new casinos in downstate New York, Stacey Rowland, chairperson of the New York Gaming Association, said uncertainty around the impact of icasino was a primary reason why digital operators should be tethered to a land-based casino in the state.

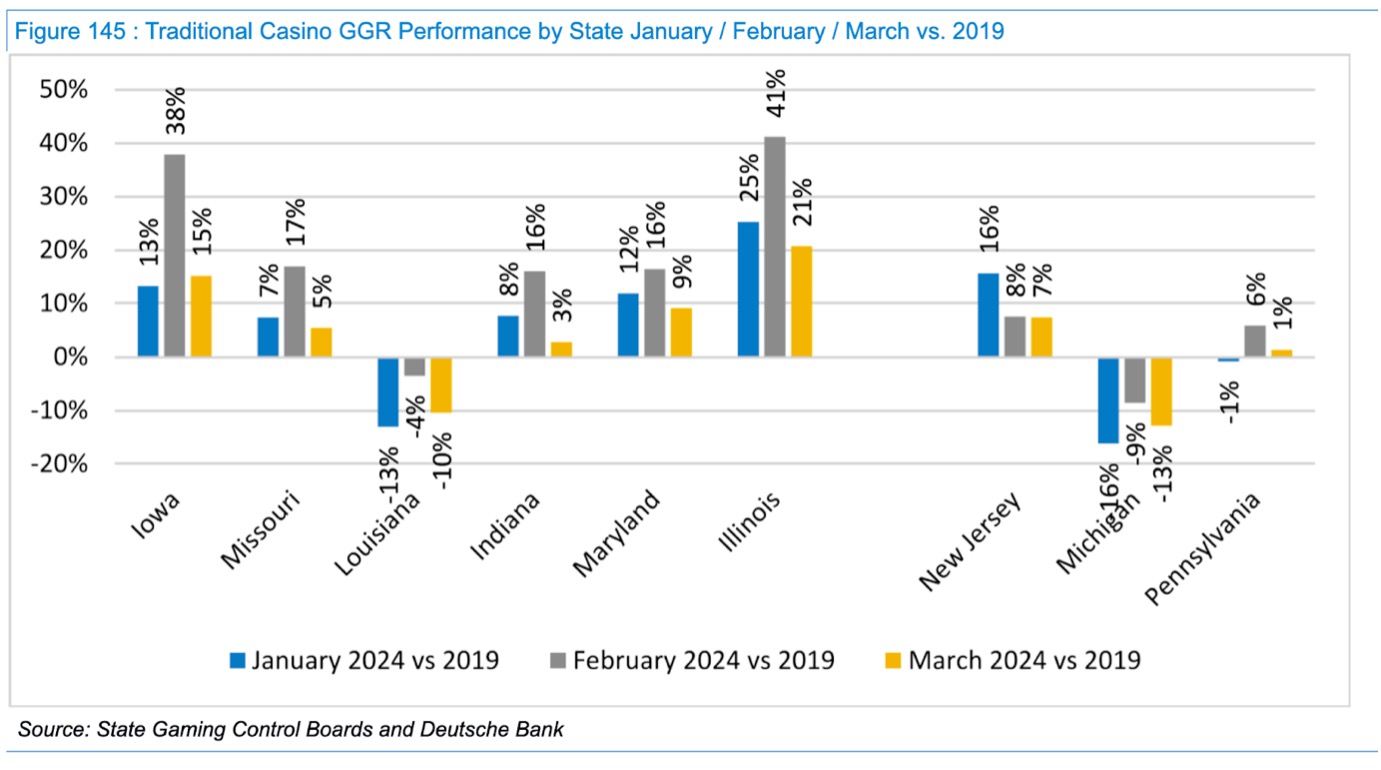

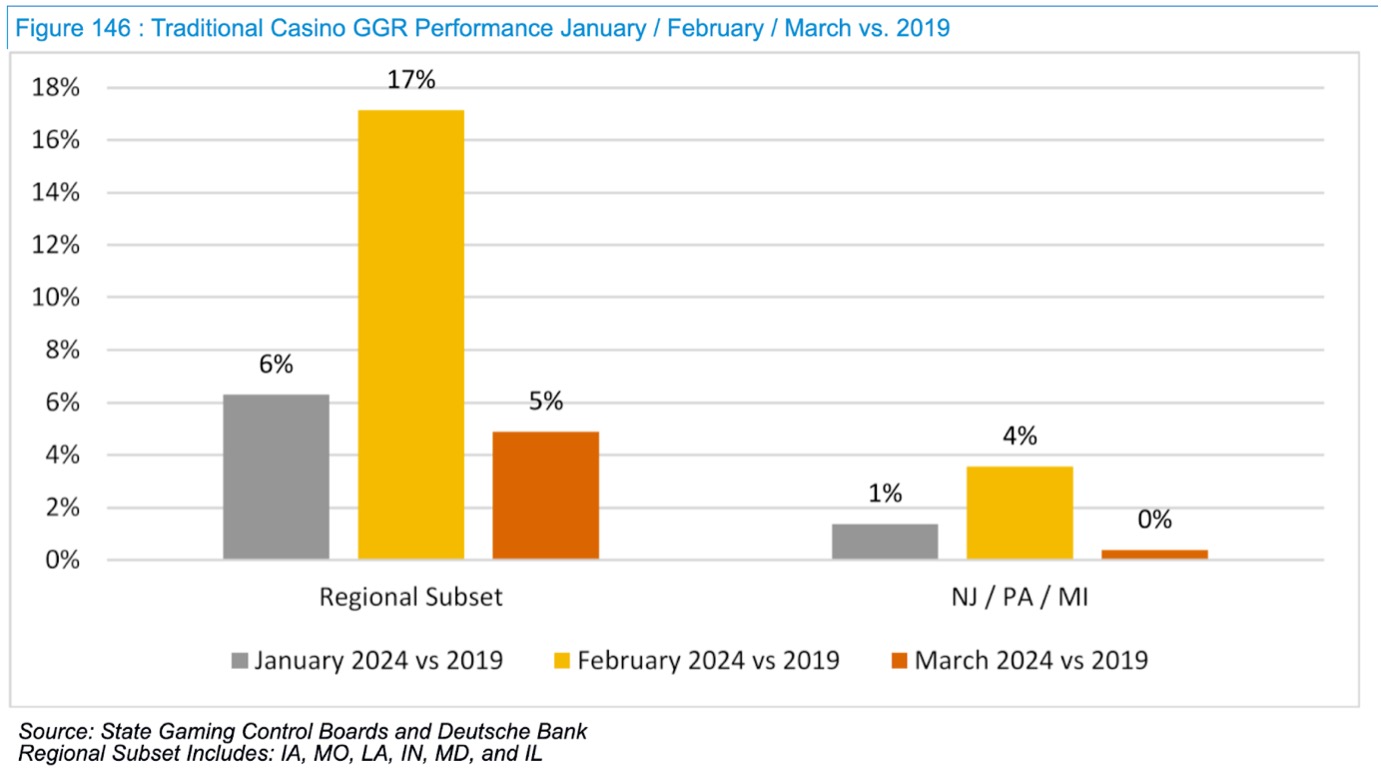

Cause and effect: Deutsche Bank has commented on the topic in the past and in its March recap note said “there is a fairly obvious argument that icasino is responsible for the sluggish relative trends in certain states”.

New states unlikely in 2024: Further icasino regulation is unlikely, or “limited in 2024”, according to Deutsche Bank, which added that its future total addressable market (TAM) forecast for online casino “includes both Indiana and Illinois legalizing and launching in 2026”.

- Including those states, Deutsche Bank’s icasino TAM estimate for 2027 came to $10.4bn versus its prior forecast of $9.5bn, with Indiana and Illinois generating around $2bn of that total.

- Current legal icasino states are forecast to generate around $8.35bn in GGR by 2027, while New Jersey and Michigan are the first states expected to record more than $2bn in GGR in 2024.

- Risky business: Over the past 12 months icasino GGR came to $6.5bn and Deutsche Bank said its “$8.3bn 2027 forecast for the currently legalized states is not without risk, as it implies that: the extraction of promos over time will have little to no impact on GGR results, and existing state run rate GGR results expand by ~25% from current run rate levels (a ~5.8% 4-year CAGR)”.

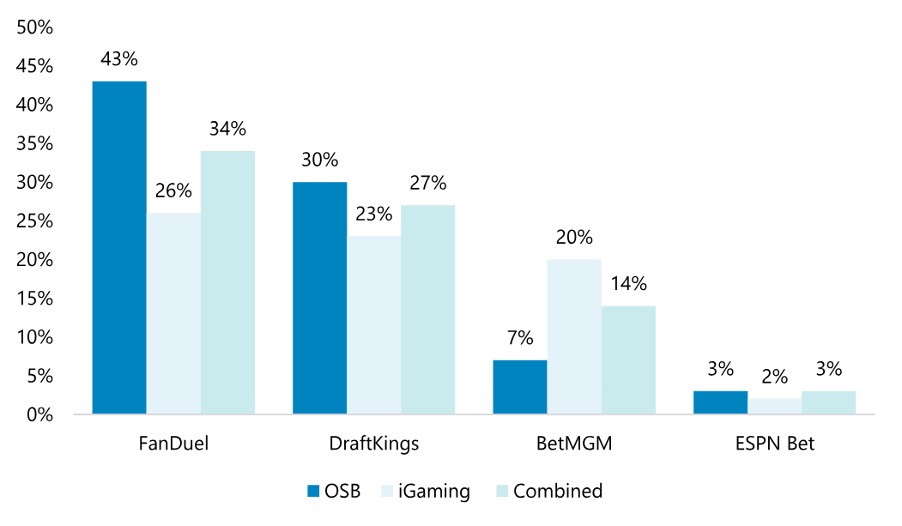

- For online sports betting, Jefferies’ monthly data revealed that FanDuel maintained its online sports betting lead of GGR share at 43% MoM across 16 states in March. DraftKings was down 7ppts to 30%, BetMGM down 3ppts at 7% and ESPN Bet was up 1ppt to 3% share of GGR.

- Across both online sports betting and icasino verticals, FanDuel leads with 34% GGR share (+3ppts), followed by DraftKings at 27% (-1ppt), BetMGM is flat at 14% and ESPN Bet has 3%.

Source: Jefferies/H2 Gambling Capital

Source: Shutterstock

Caesars’ mitigating circumstances

CEO Tom Reeg spells out list of factors that hit Q1 performance.

Everything everything: Caesars Entertainment’s CEO Tom Reeg expressed his disappointment at the poor performance of the company in Q1 and told analysts the group wasn’t “in the habit of delivering quarters like this” as revenues were down 1.2% year-on-year to $2.7bn and adjusted EBITDA was down 10% to $853m. “Everything that could go wrong for us did,” Reeg said, pointing to the group’s poor hold levels in Las Vegas, the expensive digital launch in North Carolina and other factors causing “over $75m of one-time negatives in the quarter”.

- However, Reeg also noted the positives from Caesars’ digital launch in North Carolina and said the group has recorded almost 9% market share in the state as Q1 online revenues rose 18.5% to $282m and EBITDA came in at $5m.

- “If you strip out that launch, we were $25m of EBITDA, online sports betting revenue was up 33%, and icasino, not impacted by North Carolina, was up 54%,” noted Reeg.

Quick maths: When Caesars relaunched its digital offerings in 2021, Reeg stated that the group would generate $500m EBITDA from its online activities in 2025. Commenting on the forecasts, he said: “We did $1bn of net revenue in digital in 2023 (and) reported $40m EBITDA, on a hold adjusted basis (Q4), that would be $60m. The industry is growing at 30% this year. We should be growing at least at that given our [icasino] is growing considerably faster than the market.”

- Go with the flow: With flow through at +50%, “if you take the billion, you have us grow at the market level and you flow that through, it’s very easy to do that math. If you do that again in 2025, that should get you to something like $1.7bn of revenue and something over $400m in EBITDA.”

Gaming CEOs optimistic

The American Gaming Association’s (AGA) survey of U.S. gaming CEOs has found that leading executives are optimistic about the industry’s outlook. The AGA’s Gaming Industry Outlook Index survey of 32 CEOs found that 44% of them said the current environment was good and 50% satisfactory.

- The future looks bright: Business conditions are set to improve over the next six months, according to 32% of respondents, which was up from 20% in Q3 2023.

- Gaming equipment suppliers were slightly pessimistic about the sale of gaming units for replacement use and new or expansion use (both 13% net negative). However, they remain optimistic about the pace of capital investment (38% net positive).

- Half of operator CEOs expect capital investments in hotels over the next year to be higher than normal compared to the fall of 2023, while inflationary or interest rate concerns continue to be a major factor limiting operations (28%). However, this concern has been overtaken by geopolitical risks (34%) and uncertainty of the economic environment (34%) as the biggest limiting factors.

- AGA president and chief executive Bill Miller commented: “Gaming’s record-setting growth over the last three years has set a new standard for industry success. However, as we enter a period of market normalization, continued investment and innovation in offering world-class, responsible entertainment experiences will be required to maintain industry momentum.”

News shorts

Florida’s Seminole tribe could push for icasino legislation once the legality of its online sports betting model is confirmed. Jim Allen, chairman of Hard Rock International and CEO of Seminole Gaming, told PlayUSA if the legal case linked to its sports betting operating model is “resolved in our favor” the group would initiate talks about icasino regulation.

Arcade fire: Arcade operator Dave & Buster is planning to introduce peer-to-peer wagering products across its 220 venues in the U.S. through a partnership with the tech firm Lucra. The products are set to go live in the next few months.

Typical: The German sports betting brand Tipico is looking to follow Unibet, 888 and Betway in exiting the B2C online sports betting market. The firm is reported to be looking for a buyer of its tech stack, with MGM mentioned as a potential acquirer.

What we’re reading

Laundromat: Where Ohtani’s millions went and the role of Resorts World Las Vegas.

On social

Busted: Dave & Buster’s move troubles Ohio Casino Control Commission.

A spokesperson for the Ohio Casino Control Commission told LSR it has “serious concerns” that the proposal for Dave & Busters to allow customers to bet on arcade games “appears to violate Ohio law.” The state regulator is reaching out to D&B for more information.

— Mike Mazzeo (@MazzNYC) April 30, 2024

See you in two weeks’ time!