Welcome to this week’s Igaming Focus newsletter!

In this week’s issue:

- Data points – NFL playoffs

- Download charts

- Deutsche Bank’s push and pull

- New York’s new (old) icasino bill hits the skids

- News shorts

Data points – NFL playoffs

Signs continue to be encouraging for U.S. online bookmakers, with engagement and betting activity remaining high as the 2023-24 NFL season goes into the playoffs, Jefferies reported in a note published Monday.

- December data: Figures from the first three states (Maryland, New York, Iowa) to report their December numbers suggested “a strong finish to 2023 for margins and promos”, but also implied “a -4% full year 2023 revenue guidance miss for FanDuel”, the analysts said.

- Handle was up 23% YoY, GGR increased 12% and margins were up 0.9 ppts to 9.6%. The Maryland figures however were impacted by tough annual comps as December 2022 was its first full month as a legal state. Excluding Maryland, handle was up 26% and GGR was +33%.

- On the up: The December numbers were “a marked improvement on a weak November” where margins were hit by unfavorable results and, looking at the fourth quarter of 2023, Jefferies said both handle and GGR were up 40% and 24% respectively across the three states, with margins down 1.1ppts to 8.5%.

- No promo spark: ESPN Bet’s launch in mid-November did not ”spark greater promotional intensity” from the other big operators.

- Jefferies said this was “encouraging” while JMP noted that ESPN Bet “garnered ~13% handle share in its operational states” but “market share in Iowa declined to 7% in December”. With the distorting impact promo spend has on GGR figures, analysts are using handle figures as a more reliable way to determine market share.

- The JMP team noted that it expects “promotions as a percentage of handle should be +/- 10%”.

- Absolute reducers: FanDuel and BetMGM both reduced their “absolute dollar promotional deductions in each month” of the NFL season to date and ESPN Bet’s arrival on the scene did not alter that dynamic, noted Jefferies, with DraftKings also following the trend.

- Promo spend from the top three U.S. betting brands was down 19% MoM and and -11% MoM in ESPN Bet’s first two months of November and December.

(Source: Jefferies and H2 Gambling Capital)

Download charts

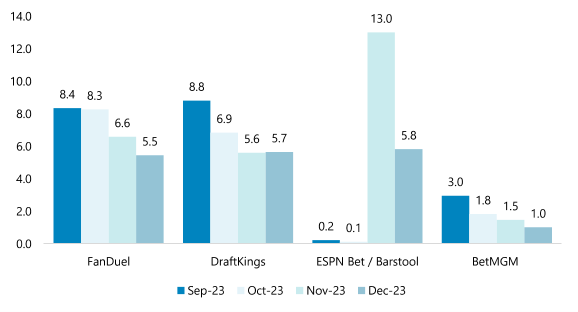

FanDuel and DraftKings regained the top two spots for app downloads for the first time since ESPN Bet launched in mid-November, JMP noted in its app download note published on 9 Jan.

- Downloads of the ESPN Bet app dropped 49% WoW as the initial signup bonus of $200 was now down to $100; this “was the second largest WoW decline since launch”, noted JMP.

- Grand finale: The climax of the NFL season and College Football Championship generated 549,000 app downloads from “the operators that control ~95% of the online sports betting market share”.

- This was a 38% drop on 2022 numbers, but that period also coincided with the Ohio sports betting launch. The two college football playoff games fell into 2024 compared to before the New Year in in 2022 and Q124 should benefit as a result.

- Download standings for Week 18 of NFL season: FanDuel 28%, DraftKings 24%, ESPN Bet 19%, BetMGM 12%, Caesars Sportsbook 6%, Bet365 6%, Fanatics and Rush Street Interactive 3%.

Deutsche Bank’s push and pull

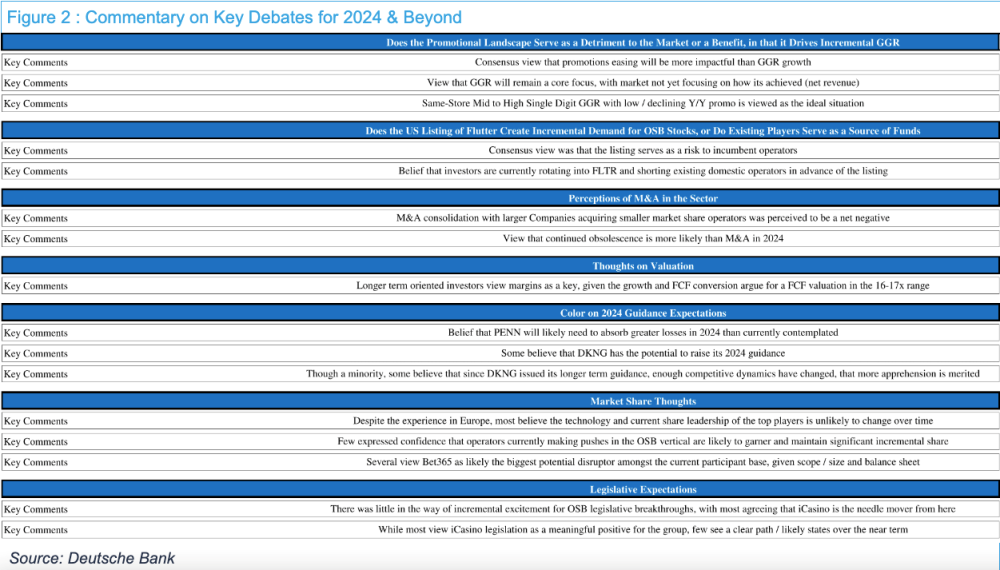

One way or another: The analysts at Deutsche Bank held their ‘OSB Bull-Bear Debate’ on the key issues likely to shape the stocks of digital sports betting companies in 2024. The forum included around 30 institutional investors, who were also sampled for “bullish/bearish investor sentiment towards specific names”.

- Biggest factor: Key takeaways revealed that investors believe the slow down in promotional spend will have a bigger impact on operators’ results than GGR growth, while “same-store mid to high single digit GGR with low/declining YoY promo (spend) is viewed as the ideal situation”.

- Flutter Entertainment’s upcoming U.S. listing is viewed “as a risk to incumbent operators” with many investors believed to be “rotating into Flutter and shorting existing domestic operators in advance of the listing”.

- Central role: Operators’ margins are seen as key components of growth for investors focused on the long term, while Penn Entertainment’s ESPN Bet “will likely need to absorb greater losses than currently expected in 2024”.

- No change: Market share leaders are unlikely to change over time and few investors had little confidence that new challengers like ESPN Bet or Fanatics Betting and Gaming could gain or maintain incremental share. However, Bet365 is seen as the biggest potential disruptor thanks to its size and balance sheet.

- Moving the needle: Further sports betting legislation is unlikely to impact investors’ outlook, “with most agreeing that icasino is the needle mover”.

New York’s new (old) icasino bill hits the skids

New York Senator Joseph Addabbo’s new bill to legalize online casino gaming in the Empire State has effectively already been sidelined and is very unlikely to go ahead as New York Governor Kathy Hochul did not include it in the state’s annual budget.

- Addabbo had previously commented that “2024 should be the year for igaming and ilottery in New York given the fiscal situation of the state” and estimated that New York could generate $475m annually in tax revenues from digital casinos.

- Having tried to introduce a bill to regulate the vertical in 2023, the new draft contained many similarities to last year’s effort.

- $10m and counting: As outlined, licensees would be required to pay 30.5% tax on gross gaming revenues and individual operators would pay a one-time $2m fee to the New York Gaming Commission. Platform providers would also be required to pay a one-time fee of $10m.

- Physical casinos, federally recognized tribes with existing relationships with the state, video lottery parlors that offer live racing and existing sports betting operators would be allowed to apply for licenses.

- The text also includes legislative outlines for ilottery and allocates $11m in funds to help players with gambling addictions.

- Addabbo said he doesn’t believe icasino portals would cannibalize retail casinos. He is due to address the Senate’s Racing, Gaming and Wagering Committee and final budget approval would have been needed by April 1.

News shorts

World of confusion: New advertising standards outlined by the Alcohol and Gaming Commission of Ontario around the use of “cartoon figures, symbols, role models, social media influencers, celebrities, or entertainers who would likely be expected to appeal to minors” have been outlined to operators in the Province.

- The revised version of the AGCO text follows strong criticism of the volume of igaming advertising on television since the Province regulated its online gambling sector in 2022.

- The new text also bans operators from using “active or retired athletes” from promoting sports betting websites, “except for the exclusive purpose of advocating for responsible gambling practices”.

- The new restrictions are due to come into effect at the end of February.

Kristian Nylen, co-founder and CEO of the sports betting solutions provider Kambi, has announced that he will be stepping down from his role and will remain with the company until they have appointed a successor. Nylen set up the company in 2010 after a decade with Unibet’s parent company Kindred Group and coincides with Kambi’s rollout of Tzeract, its new AI-powered trading tool.

Australian betting behemoth Tabcorp has been ordered to stop accepting cash at its wagering machines in the pubs and clubs of Victoria unless under proper supervision after a teenager with gambling addiction placed bets at multiple venues in the state and lost close to $100,000. The matter is the subject of ongoing court action.

Illegal attractions: Danish players who gamble on unlicensed websites are attracted to those operators by the prospect of higher bonuses and the different types of games on offer, according to a major new study. At the opposite end of the scale, respondents said credibility and availability of the Danish language as reasons for gambling with licensed sites.

Further reading: From Loto Foot to Bet Builder, sports betting through the years