The five-year anniversary of the PASPA repeal shows how much progress has been made by regulated operators in the U.S., but speedy expansion has also brought with it reputational risk and a negative narrative on problem gambling that may prove difficult to shift.

The past two weeks have been marked by the five-year anniversary of the Supreme Court ruling that overturned the Professional and Amateur Sports Protection Act of 1992 (PASPA) and paved the way for the broad and fast expansion of sports betting regulation across the U.S.

Five years may be a short amount of time, but it’s obvious that within that time frame the industry and its stakeholders have been hugely successful in achieving many of their regulatory and business goals.

From Nevada being the only state where sports betting was legal (Delaware is somewhat of a special case) to seeing the vertical regulate and operate legally in some 35 states, regulation of the industry has spread at a speed few would have anticipated in 2018.

To quantify that expansion, the American Gaming Association recently revealed that sports betting has generated a total of $3bn in state and local taxes since May 2018 and 39.2 million American adults have placed a sports bet in the past 12 months.

The AGA adds that since 2018 around $220bn has been wagered by players on regulated sportsbooks, and according to Better Collective’s Chris Altruda, U.S. operators have recorded a total net win of close to $17.6bn.

Spot the ad

But most notable, in every sense of the word, has been the level of advertising from bookmakers. To show how much it has grown, the consultancy iSpot.tv reveals that in 2019 just over $21m was spent by betting brands on national TV commercials after a first full year of regulated sports betting. In 2022, it estimates that operators spent nearly $315m on TV advertising.

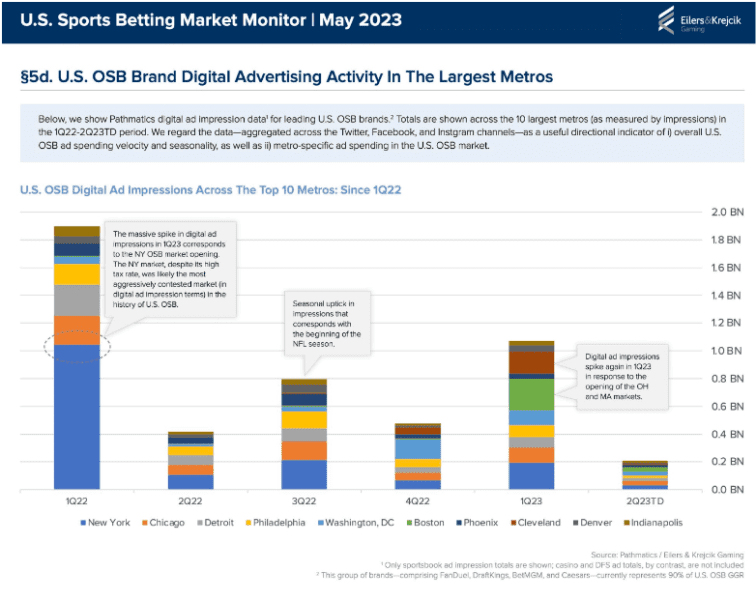

When it comes to digital advertising, analysis from Eilers & Krejick shows that FanDuel, DraftKings, BetMGM and Caesars Interactive, who in total represent 90% of U.S. market share, also showed where operators spend the most in the largest metropolitan areas.

While New York and Chicago unsurprisingly account for much of the ad impressions, it’s also notable that 12 months after New York regulated sports betting, ad impressions have dropped from just over 1 billion in the first quarter of 2022 to around 200 million in the corresponding period this year.

This suggests that operators, FanDuel and DraftKings in the main, are still advertising online, but at nowhere near the levels of 12 months ago when New York’s ‘land-grab’ marketing phase was in full flow.

But whether it is on interactive platforms, TV, radio or in stadiums, the impossible-to-miss visibility of so many betting brands is also what riles up so many critics.

Raised profile, reputational impact

If regulation has been a major factor in raising the profile of U.S. sportsbooks, it is no exaggeration to say that it has also impacted its image and reputation. Critics object to the amount of betting advertising because of worries about problem and addictive gambling, while some also look on the industry as being too opulent and in poor taste.

This is due to the amount of gambling advertising that appears on mainstream platforms around sporting events and the numerous sports betting TV shows, podcasts and online media that appears daily. These questions were already relevant two years ago with regard to U.S. advertising levels and that will continue to be the case in the next few years.

Playing defense

In many ways that is also one of the paradoxes of the past five years. For all the regulatory expansion of sports betting, which is a significant positive for U.S. consumers, jurisdictions and operators; it also feels like the industry is constantly on the defensive when it comes to communications, its image and responsible gambling.

This can be ascribed to the numerous and loud complaints that have been made about the omnipresence of gambling advertising and the speed at which it has happened, but also because operators don’t seem to have imagined that such reproaches could be targeted at them, even more so when they were so busy launching in new states, convincing investors that they are viable businesses and now are fully focused on reaching profitability.

This is what mental health advocate Jamie Salsburg alluded to when he told ESPN “the biggest surprise has been a lack of surprises” when it came to responsible gambling. He added that the eventual regulation of online casino “will come with a steep societal learning curve” that will “be rough, but so will the overreaction to it”.

The result will be wild swings “in each direction and we won’t get much traction to move forward in a healthy and productive manner”. In other words, it is highly likely that there will be a lot of furious arguments over the harms or otherwise of gambling from both sides of the debate.

This, to a large extent, is what has happened in the UK over the past 15 years. The French describe it as “a dialogue of deaf people”, but in this case it comes with copious toppings of acrimony and recriminations. The U.S. industry should ensure it does all it can to avoid such a fate.