Highlighting the threat posed by unregulated operators on the legal market is understandable, even if the objectives are not always met.

The size and reach of illegal online gambling operators targeting players in regulated markets is an ever-present fact of life for licensed, regulated and taxed online sports betting or casino groups, and that is particularly so in the case of the U.S. market.

The reason for this state of affairs to a large extent is because up until 2018, the U.S. was unregulated and the returns for operators working out of Costa Rica, Aruba or Curacao that target U.S. consumers were, and still are in some cases, too attractive and risk-free to ignore.

There have been arrests and clampdowns. A trip down memory lane reminds us of BetonSports CEO David Carruthers back in 2006 getting collared in Texas as he changed flights on his way to Costa Rica, and (as then was) Sportingbet chairman Peter “I only had a cashmere jumper I could use as a pillow in my New York holding cell” Dicks followed not long after.

And of course there was the FBI’s own version of Black Friday in 2011, when it shut down PokerStars and Full Tilt Poker and all the worst rumors about how Full Tilt was run were confirmed and most players lost their bankrolls.

But, overall, the legal risks for executives still operating unregulated sites have been minimal, which can’t be said about the returns they continue to generate from the U.S.

As for liabilities or risk management, the risk of big payouts to winning players is seemingly seldom present. Customer funds in most cases are at the mercy of the owners’ or management’s whims, and whenever player disputes, complaints or requests for large withdrawals arise there is usually only one way that they end.

Data points

With that in mind, it was interesting to see the major piece of research published by the American Gaming Association last week that quantified the value of the black market for online sportsbooks and casinos targeting U.S. players.

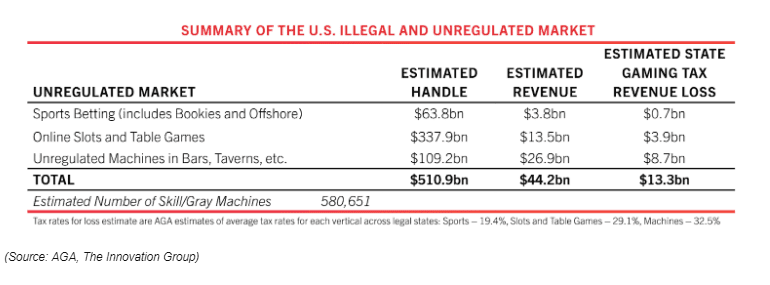

For the purposes of this article, we will leave out the (substantial) handle and revenue figures quoted for the unregulated gaming machines in bars and catering venues across the U.S. and focus on online sports betting (OSB) and casino (iCasino).

As shown by the table below, the headline figures are that the unregulated OSB market generated an estimated $63.8bn in handle and $3.8bn in gross gaming revenues (GGR), while illegal iCasino sites recorded $337.9bn in handle and a whopping $13.5bn in GGR. In the process, state authorities are missing out on $700m on lost OSB tax revenues and $3.9bn when it comes to iCasino-related taxes.

To put the AGA’s figures in perspective, Deutsche Bank’s most recent monthly OSB and iCasino tracker showed that U.S.-regulated digital sportsbooks recorded $5.4bn and online casino sites $4.8bn in GGR between January and October 2022.

In other words, and assuming the AGA’s data is accurate, illegal operators generate 70% of regulated sports betting operators’ revenues and an astounding 181% (my emphasis) more when it comes to regulated iCasino GGR.

In its press release, the AGA stressed these points, saying that “with Americans projected to place $100bn in legal sports bets this year, these findings imply that illegal sportsbook operators are capturing nearly 40% of the U.S. sports betting market”, while the “illegal iGaming market in the U.S. is nearly three times the size of the legal U.S. iGaming market, estimated to be $5bn in 2022”.

Research matters

Research into the gambling black market is important and clearly matters as a way of showing legislators and opinion formers that high levels of ‘channelisation’, ensuring that as much of the consumer demand is channeled and recorded by regulated operators, are achieved.

As the AGA’s graph below shows, out of 5,284 U.S. players surveyed, just over half play on regulated sites and 30% play on “illegal channels”.

However, it’s also worth wondering how successful these reports are in convincing politicians, regulators and mainstream media of the case being made. Looking over the other side of the Atlantic, the UK’s trade body the Betting and Gaming Council has long banged the drum about the risks posed by illegal operators targeting UK players.

However, it is repeatedly ignored by mainstream press organs when it flags these up or is dismissed by anti-gambing campaigners, who often characterize the data as being devised to favor industry lobbying for lower taxes or minimal restrictions on advertising.

The French online gambling market faced similar issues shortly after it was regulated in 2010. As a reporter based in France at the time and covering the market closely, the complaints from industry executives were loud and numerous and widely reported; but were regularly ignored by the authorities.

The irony was that the groans from commercial operators were justified. For example, even after regulation came into effect, online access to many major UK operators was completely open and unimpeded from France, with many high-staking punters logging into their accounts without any problems. In that regard at least the French-licensed groups’ complaints were successful in forcing UK books to geo-block French players.

With regard to the U.S. market size is of course the key difference; and apart from New York, the three other most populous and economically powerful states in the country have still not regulated online sports betting or casino. This means that however many online bettors or casino players there are in California, Florida or Texas, all are playing on illegal sites.

Due to the nature of the industry, it’s impossible to be certain of the scale of the black market when it comes to online gambling in the U.S. and the New York Times’ recent reports on the industry suggest the AGA has its work cut out when it comes to convincing opinion formers. All it can do is continue its work and, as mentioned two weeks ago, within that environment U.S. regulated operators must ensure they work to the highest social responsibility standards possible.