The lackluster performance of some of the land-based giants shows how important digital know-how and product are in igaming.

With the first quarter reporting period ending and the 2024 NFL season drawing to a close in the past month, the ups and downs of the different operators targeting U.S. players show that there have been subtle shifts in how the industry has evolved stateside up to now.

The first obvious point to make is that in the space of the three years since we all emerged bleary-eyed out of COVID lockdowns, the early assumptions about how major land-based gambling companies would be able to leverage their brands, reach and customer databases to make hay in the online sphere have been well and truly debunked.

Early assumptions around how groups like Caesars, MGM or, to a different degree, Penn Entertainment, through its regional resorts and tie up with Barstool Sports, would be able to leverage their real estate assets and gain mass adoption from their player databases have not worked out.

And with iCasino only regulated in six states, with little certainty of more coming onstream anytime soon, the online sports betting app download and market share tables seem to be set for some time at least.

On the downloads

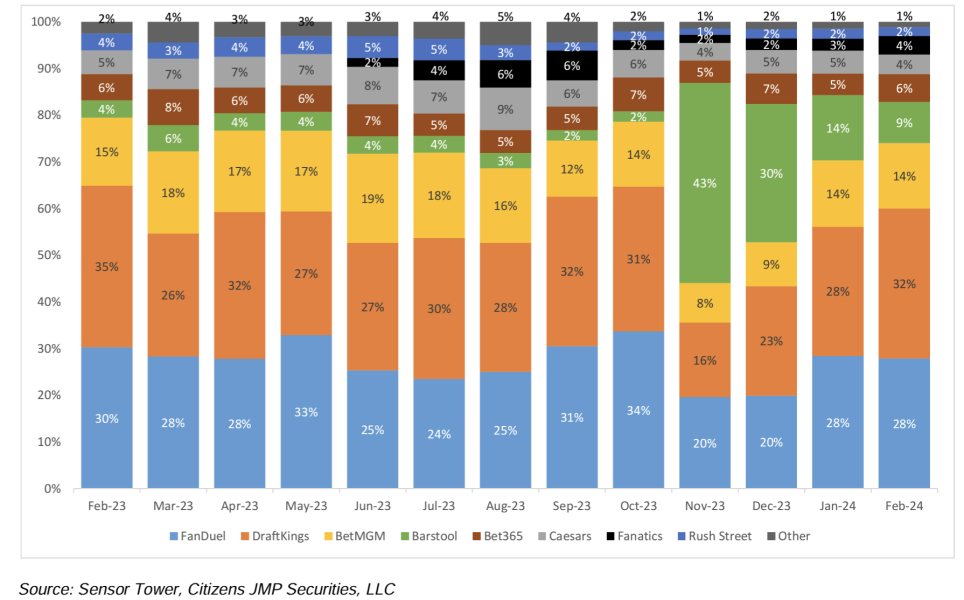

Speaking of betting app downloads, the team at JMP revealed that Caesars and BetMGM lost -70bps and -20bps at 4% and 14% respectively in share of app downloads in February, while FanDuel and DraftKings have gone back to the levels they were at (28% and 32% respectively) prior to the ESPN Bet launch in mid-November.

Meanwhile, the latter’s share of app downloads dropped -520bps to 9% compared with its January performance, but in a sign of the progress it has made since relaunching on theScorebet’s tech stack, its trailing 12 months average share of app downloads stood at 14%. Much better than the 5-6% it finished with when it was operating Barstool Sports, while the number of downloads it recorded were up 220% on an annual basis.

Still, app downloads are just one metric, and the proof of whether ESPN Bet succeeds or fails will be in the gross revenue and EBITDA figures it publishes in the next few quarters. As I wrote two weeks ago, its fourth quarter losses were $334m and, when combined with losses for the whole of 2024, will reach $700m-$750m. These figures are “considerably greater” than the previously mentioned range of $200m-$400m, the Deutsche Bank team said, and “meaningfully higher than investor expectations”.

And as ever, its fortunes will come down to whether it can drastically reduce marketing and promotional expenditure to simultaneously increase market share. But as I reported last week, ESPN Bet’s share of gross revenues was down -3ppts on a monthly basis in January as it reduced promo spend and saw its GGR share go from 8% in November to 5% in December and to just 1% in January.

Caesars’ iCasino woes

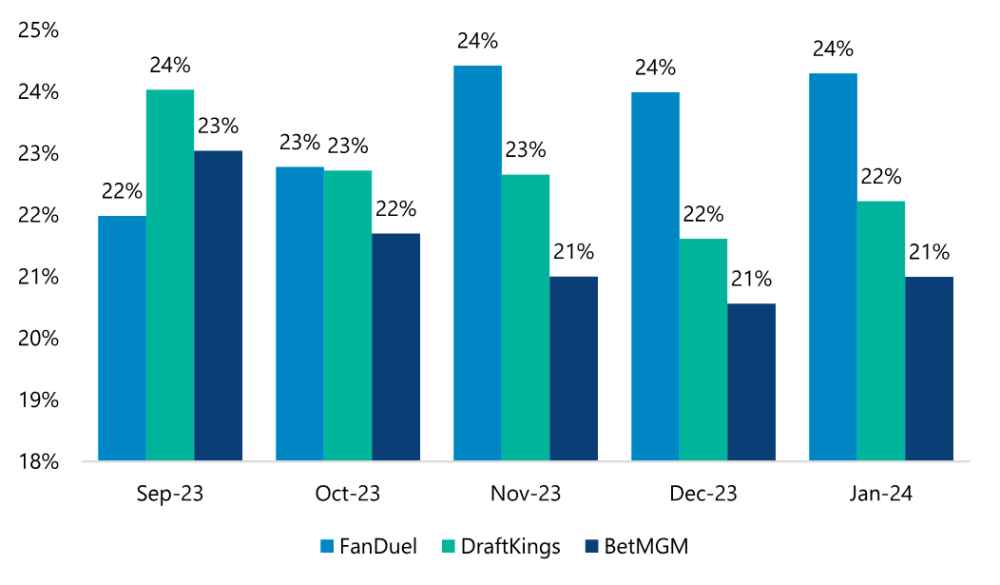

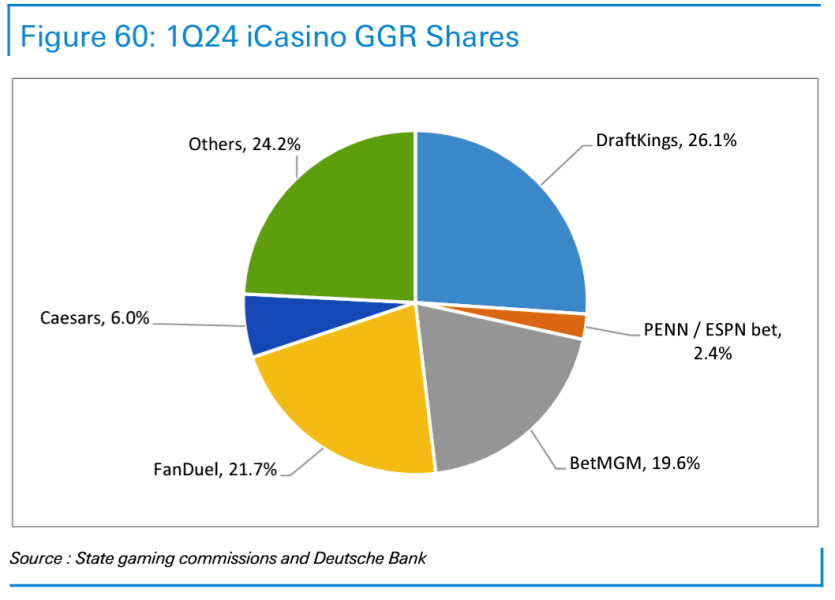

In online casino, meanwhile, Caesars, which was expected to leverage its 56 million strong player database, continues to disappoint in what should be its core strength. All five igaming states reported their data for January and while GGR across the jurisdictions increased +20% on an annual basis and Michigan, New Jersey and West Virginia set new state records, Caesars did not make the top three in the vertical.

DraftKings led with GGR share of 25%, but when taking out the contribution of Golden Nugget, it was second with 21% and behind FanDuel which had 24% share of GGR and BetMGM’s share was down -5ppts on a manual basis to 21%. As the Jefferies team noted, “FanDuel remained the #1 iGaming brand for the fourth consecutive month”.

Deutsche Bank, meanwhile, revealed that the group recorded just 6% share of iCasino GGR in the first quarter of this year. Despite buying up Wynn’s online casino operations in Michigan in a bid to boost its fortunes in one the ‘three big’ iCasino states, Caesars must be bitterly disappointed at such a poor digital performance.

Product, product, product

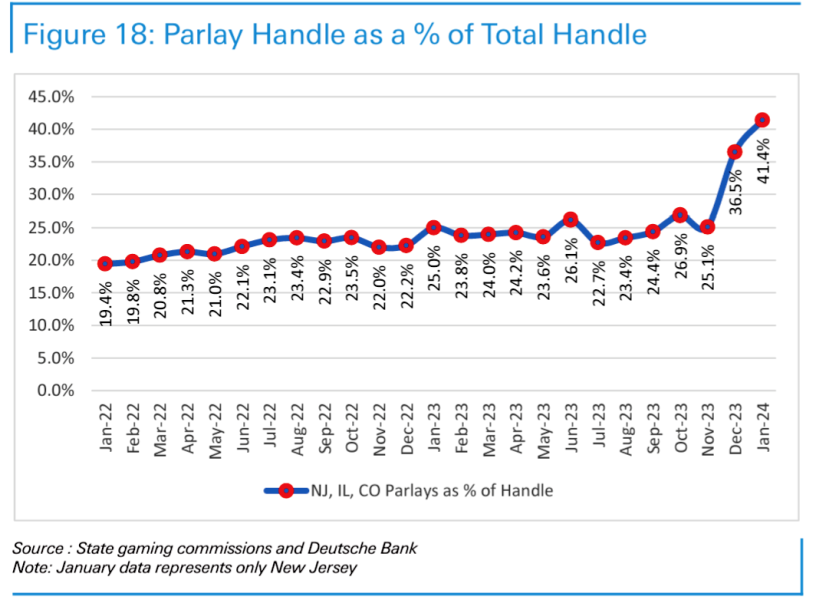

As ever in online sports betting, the most successful operators in the field are those that have the best quality product. Put a simpler way, those that have the best parlay products will generate the best margins, which will drive their revenue and EBITDA figures.

The JMP team revealed that 58% of bets were single-game bets in February vs. 60% in 2023, while parlays represented 39% of wagers compared with 34% last year, even if single-game bets of 81% of handle compared favorably with 60% in Feb23 as parlays dropped to 18% from 36% of handle in 2023.

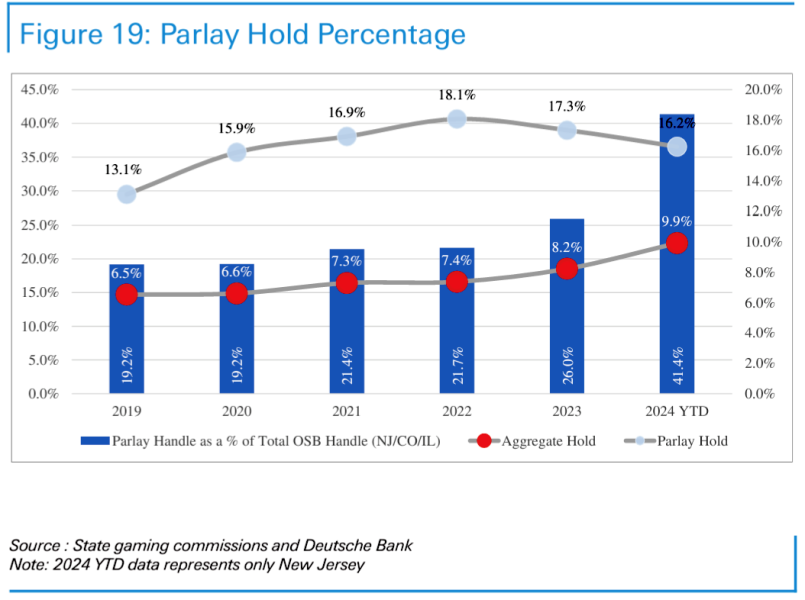

On an annual basis, the importance of the product was highlighted by Deutsche Bank, which said “parlay mix grew steadily for most of 2023, relative to 2022, as a percentage of the total handle” and in January it grew 41.4% of handle compared to 25% last year (in states where data was available. It also said it believed Illinois had some “reporting issues”).

In 2023, parlay products showed their value as they generated margins of 17.3% compared to aggregate hold levels of 8.2% and already reached 16.2% in January this year.

Finally, as North Carolina prepares to open up to regulated sports betting, DFS operator Underdog Fantasy will make its first foray into fixed odds sports betting as it readies to launch in partnership with the PGA venue Sedgefield Country Club on March 11.

It will be fascinating to see if it can gain a foothold in the space as it competes against two runaway leaders who are being chased by corporate heavyweights. Again, it will all be about product, engagement and a strong user experience.