In the “slot system” world, the pace of change seems to be as rapid as the geological movement of tectonic plates. The four main players are roughly: 1. Light & Wonder (Bally); 2. IGT; 3. Aristocrat; and 4. Konami. There are also some interesting new competitors, including Acres Manufacturing (“Foundation”), CasinoTrac, and a handful of even smaller players.

But that rank order of the top four has been solid for at least two decades or more. (Check the Background topic below for a time when things were moving a bit faster.)

The reasons for this static state are pretty basic. Systems are expensive. Very expensive. Even more so, they require months of training to master. Therefore, replacing a system is far from simple.

Any new sale is also complicated by requiring multiple departments to reach a consensus (something akin to getting a bi-partisan law passed in Congress).

For Randy Caron, Konami Gaming’s vice president of systems sales, it can be a difficult journey to make a pitch: “You have to sell to at least three to five people in the operation and get them on your side. And, you know, you’re doing this over the course of a year or more, and then lots of times during that period, people leave, so now you’re starting over with this or that slots or marketing leader and then there can be shifts in the casino’s priorities over time. It’s pretty crazy.”

As mentioned above, change these days is not something that happens overnight. However, for “systems junkies” like me, any movement, rumor or whisper can be enough to generate excitement. Accordingly, the latest buzz is that Konami’s SYNKROS system seems to be on a roll. They have had success in replacing their competitors’ products in some high-profile operations. While they are not likely to jump into third place any time soon, there are signs that they are on an upward trend.

As mentioned in the Background below, one of the pioneers of the systems category is John Acres. When he recently launched his new system called Foundation, he liked to say that all the existing systems today are still using 1990s technology. He often shows up at sales pitches with a ‘90s Motorola cell phone (shown) to make his point.

As mentioned in the Background below, one of the pioneers of the systems category is John Acres. When he recently launched his new system called Foundation, he liked to say that all the existing systems today are still using 1990s technology. He often shows up at sales pitches with a ‘90s Motorola cell phone (shown) to make his point.

This failure to keep up with technology is nothing new for our industry. When Konami purchased a Las Vegas startup system called Paradigm Gaming in 2001, virtually all the competing systems were using telephone-like twisted pair cables to connect their slots in a daisy chain arrangement. Compared to today, that was the equivalent of hooking two tin cans together with string to talk with your 3rd grade friend in the house next door.

Steve Sutherland, who was (and still is) heading Konami Gaming in the U.S., was excited to spot a company that was pioneering Ethernet technology. They were using this high-speed communication protocol and pairing that with an Oracle database. Then and now, Oracle is the database leader.

But Konami’s subsequent acquisition came with pros and cons. The system needed some work. Sutherland quickly hired database expert Tom Soukup to oversee the product launch. Reportedly Soukup – who today is the Sr. VP & chief systems product officer – and his team took a year or two to rework and improve the software and hardware before launching it for sale.

An even bigger “con” was since no one else was using Ethernet, it added additional expense. Any casino with the older cables had to completely re-wire their floor and purchase a network of new switches and servers. That could often add $500,000 to several million to the installation costs. Today, virtually all the systems are using Ethernet protocols, but in the early 2000s, Konami was alone.

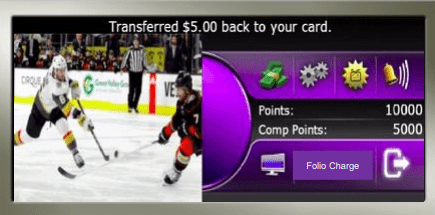

On the plus side, this much faster technology allowed Konami to do things that no one else could, such as displaying video messages (even live TV sports) directly to their display panels on the slots. Again, this is more common today, but Konami was far ahead with this capability.

On the plus side, this much faster technology allowed Konami to do things that no one else could, such as displaying video messages (even live TV sports) directly to their display panels on the slots. Again, this is more common today, but Konami was far ahead with this capability.

Almost as important was their Oracle software foundation. Most of the data dictionaries and code of competing slot systems was proprietary. That made finding IT personnel with experience in those systems very difficult. On the contrary, Oracle was being used throughout the country in countless retail, customer service and industrial applications. Experienced programmers and coders were readily available. This remains a strong selling point for Konami today.

With all these technological advantages, it may seem hard to understand why Konami didn’t leap to the head of class. After all, customer satisfaction was never the strong suit for any of their competitors. Indeed, it has always been an industry joke that the absolute worst system is “the one we own.”

Why the cynical disdain for perhaps the most critical and important tool in any casino? As referenced earlier, it has to do with price, complexity, training and history. Suffice it to say when there’s a system problem, it is seldom minor. Whether outages occur from upgrades, operator errors, equipment failure, faulty wiring, software glitches or ransomware attacks, it can result in disastrous damage to casino revenues. Commonly, slot machines won’t pay out, ATMs crash, hotel room keys might not work, restaurant reservations can vanish, and cashiers are left adrift with only paper and pencils to reconcile accounts.

Any system can fail, but reliability is one of the apparent strengths of Konami. Caron says, “SYNKROS is one database, one code base. There are settings and functionality that users can turn on and turn off based on what jurisdiction and what’s approved.”

This common base of software is a big plus. “Because it’s one code base, we provide software upgrades at no charge every year to our customers,” Caron notes, “and upgrades are often completed in four to six hours. A lot of times they’re done in two or three hours.”

This can be incredibly important to operators. As a consultant, I have found more than a few operators are using systems that are two to 10 upgrades behind. It is usually due to their fear (or the perceived hassle) of doing a difficult update.

This is a problem caused, ironically, by the operators themselves. In the past, many casinos may have requested custom features for their system software. While that may sound reasonable, it has the unintended consequence of creating a tower of babel for programmers trying to do upgrades. Because of this custom code and individual features, every time a standard upgrade is issued, those with custom code will hit unexpected issues or incompatibilities. A uniform code base greatly simplifies this procedure.

Caron agrees and adds, “I think if you asked 20 or 30 of our existing customers, one common theme would be that we are super, super, super reliable.”

Counterpoint

While Konami has some strong features and seems to be enjoying an upswing, I am of the strong opinion that each one of the four major systems, along with Acres Foundation and CasinoTrac, are all superb. I strongly believe that much of the frustration with systems in general is due to issues with the operator, and not necessarily the provider.

That is not to say that there are no shortcomings. Sensing a competitive new revenue stream, no current provider seems willing to agree on a single “standard” for future cashless strategies. This important milestone will never become popular if players are forced to “learn” four or five different ways to access their money. Can you imagine if you had to use a different card or methodology to buy something at every individual grocery outlet, hardware store or online retailer? But don’t get your hopes up that the industry will adopt a single cashless “standard” anytime soon.

Likewise, I personally believe that the reporting and analytical functions on most of these systems is lacking. They all have been getting better each year but are still behind in this area. They all meet the regulatory reporting requirements, but digging out useful, actionable strategies is not their strong suit. Fortunately, pairing any of these systems with one of the newer AI-based analytic programs is a no-brainer solution.

That said, if you are having system issues today, here are some suggestions to consider:

- Stop asking for custom features and eliminate those you added in the past. Get back on the vendor’s standard code version ASAP. Do you really think you have discovered some report or data point that will make you that much better than everyone else who are using “tried and true” practices? Instead, you’ll just clutter up your code, complicate upgrades and fall behind.

- As mentioned earlier, make sure your system is up-to-date. Timely upgrades provide better security from the latest threats, fix minor bugs and add valuable new features. (Heeding #1 will make it so much easier.)

- Keep in close touch with your vendor. Consistently ask them about best operational practices, new features and training opportunities. Of course, that should be the obligation of the vendors themselves, but it is your casino that will be hurt if they go radio silent. Don’t let it happen. You need to always be the proverbial “squeaky wheel” to make your system be the best it can be.

- Get more training. I often encounter operators that are lustful about a feature touted by another system. When I tell them that their current system has the same capability, they seem surprised (re-read #3). The grass isn’t always greener elsewhere. You can never stop learning.

- Get even more training for more levels. Turnover in our industry is not rare. Your best system experts in each department could be gone tomorrow. Make sure there are at least one, two or three understudies for every critical role. This also serves the bonus role of career development and generating future leaders.

- Clean up your database. It is painfully common for slot machines of the exact same type to have several different names in your system. That makes analytics difficult. Aristocrat’s “Bao Zhu Zhao Fu Red Festival” seems to be the most recent offender along with its several color variants. BZZF Red, Red Festival, Bao Red, Zhao Fu, Red Firecrakers and others are all the same game … but your database doesn’t know that!!! Don’t forget to do the same with your Player lists. If snail mail, email, Free Play offers or SMS messages are consistently returned unopened, not used and/or ignored, find out why (and fix it) instead of letting it slide into another month (or year) of wasted marketing efforts.

Background

The early years of slot systems were a lot more dynamic than today. The transition of slots from mechanical one-armed bandits to digital reel spinners and video game-like displays opened the door to today’s slot systems. Combined with a nationwide expansion of gaming, this was a boom for systems. Below is an abbreviated, and very loose, history of the three other major players.

BALLY (Light & Wonder)

It was in 1978 when the Bally SDS slot system emerged from its development lab in Reno, NV. Headed by the legendary Inge Telnaes, the first version was installed at Harvey’s in Lake Tahoe. It was a far cry from today’s all-encompassing applications.

As its name implied, it was the first true Slot Data System. It automatically counted Coin In, Coin Out, Handle Pulls, Jackpots and the like. As hard as it may be to imagine today, casino managers seldom had any idea how much money they were actually making (or losing) from their slots until days or weeks after the fact.

In the early 2000s, Bally acquired New Jersey-based ACSC (Advanced Casino Systems Corporation). Sometime before, ACSC, running on Unix and IBM mainframes, had combined with LMS (Lodging Management System). That began the trend toward slot systems that featured property-wide integration. ACSC also had a near monopoly in the Atlantic City market, giving Bally an even larger installed base.

In 2003, Bally also bought CMP (Casino Marketplace), which was developed by young computer programmer Bill Watson in Reno. It combined player tracking with several marketing and bonus features. One of CMP’s first salespersons was Derik Mooberry, who would later become CEO of Bally Gaming. With SDS/CMP and ACSC, Bally had full casino integration offered in two different types of hardware/software technologies.

IGT

Just a few years behind Bally’s basic SDS, another industry legend, John Acres, took note of the airline programs offering benefits to frequent flyers. He saw no reason why casinos couldn’t do the same for their slot players. His first company, EDT (Electronic Data Terminal) was formed in 1981 and became the industry’s first player tracking system using magnetic cards. His early work was the bedrock for all of today’s player tracking efforts.

Following that lead, IGT introduced their SMART System (Slot Management and Accounting and Reporting Technologies) around 1980. This was the same time that IGT became the leading slot machine provider, taking the long-held title away from Bally. They were able to gain system market share by offering steep discounts on their software, especially to new casinos who signed up for large IGT slot purchases. This was especially important with the emerging Native American operators who were short of capital.

In 1992, John Acres launched his second company, Acres Gaming. This system was the first true automated bonusing program in the industry and became the foundation of well-known promotions like Stations Casinos “Jumbo Jackpots”. IGT quickly realized the potential of Acres bonusing and purchased the rights to it in 2003, re-labeling their SMART System to the IGT Advantage System.

In a rare event of non-competitive cooperation, the industry jointly adopted IGT’s SAS (Slot Accounting System) standards. This allowed all machines and systems to talk to one another. Prior to this, each system and/or machine was metaphorically speaking in a foreign language.

ARISTOCRAT

Casino Data Systems or CDS was founded in Las Vegas in 1986 by CEO Steve Weiss. In addition to a few promising slot games, they also pioneered the Oasis Slot System. Aristocrat bought the company at the beginning of 2001. At the time, it was largely based on inexpensive personal computer technology. Along with CMP, these systems became the first to prove the power and reliability of smaller PC platforms. This positioned Aristocrat as the value leader in the systems category. As mentioned above, pricing made them very attractive to startup operators, again especially with Native American casinos. It wasn’t long before they became viable competitors to both Bally and IGT.

KONAMI

Enough said above.

CONCLUSION

Before considering any new system, are you getting the most from your current one? Have you done your homework and considered all the costs of a switch?

On the other hand, if you simply must buy a new system, or you are opening a completely new property, don’t forget to check out Konami’s SYNKROS. They are on a roll.

# # #