The rate of online sports betting expansion in the U.S. has slowed in recent times and for operators and suppliers alike the trend is compounded by the FanDuel-DraftKings duopoly. This partly explains why Latin America, and Brazil in particular, is currently the focus of much of the industry’s attention.

Brazil and Latin America are on the minds of most igaming industry executives currently, and with good reason. Operators, suppliers, and consultants have been busy working on deals, and helping shape regulations in the continent’s largest markets for many years. As Brazil prepares for regulated online sports betting and casino, many of those long-term projects are now coming to fruition.

The region is, and has been, growing for some time and while Brazil is the largest and most consequential market, countries like Peru and Chile are active and new deals are also being struck in major jurisdictions such as Mexico and Colombia.

However, for all the talk of promise and growth, it’s also important to remember that all the markets in the region, especially Brazil as the largest of them, have been active for many years and have several major operators that dominate share of market and will expect to maintain that share once regulation kicks in. In addition, unregulated operators will not cease operating and focusing on the market once regulation is introduced. So, much like Europe’s regulated markets, competition will be coming from every direction.

Success factors

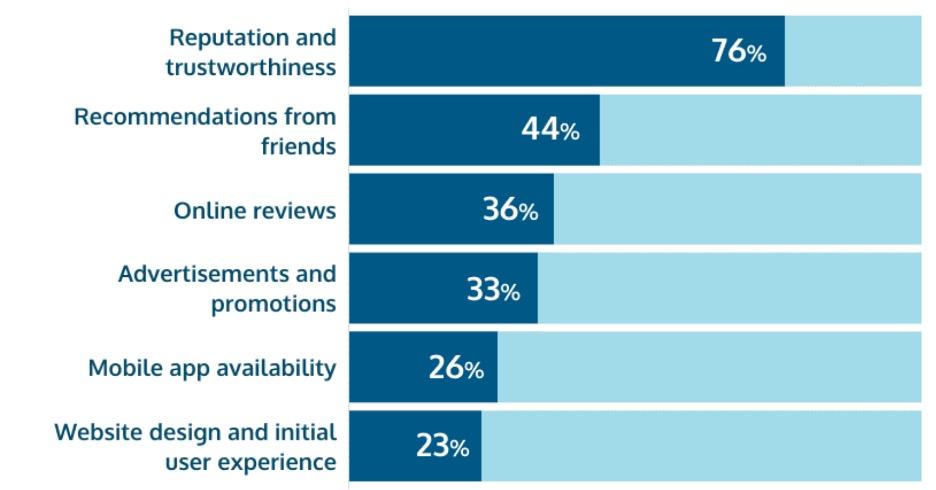

This means factors such as brand recognition, reputation, trustworthiness and word of mouth will play key roles in influencing where players decide to open accounts. This will be even more pertinent in the earliest days of regulation, when the topic will receive lots of media attention. It will be covered extensively on mainstream TV channels, as newspapers and mass market consumers talk about sports betting, and exchange tips and anecdotes on odds and wagers.

As ENV Media explained in July, reputation and recommendations are the factors that influence users the most when they choose an online bookmaker, while faster payouts (unsurprisingly) top the list of improvements bettors would like to see from operators.

(Source: ENV Media)

Clear focus

When it comes to companies that supply the industry, the majority openly state that Latin America, and Brazil in particular, are major focus areas for them.

Mateo Lenoble, vice president of account management at Sportradar, told CDC Gaming that “Brazil and the wider LatAm market continues to be a focus” and “the company will continue to work to form strong relationships with other leaders in the market to support the legal, regulated growth of sports betting within Brazil and Latin America.”

Sports betting solution supplier First Sportsbook has recently signed a number of LatAm-focused partnerships to target the region, and Brazil in particular.

Tom Light, chief executive of First Sportsbook, notes that while his company is focused on providing the best sports betting solution to the industry, “our focus on trading and generating our betting markets in-house enables us to provide a broad and comprehensive offer that attracts players. Most importantly, this means our operators are able to compete with the largest sports betting sites in the market.”

In Brazil, market leaders include giants like Betano, Bet365 and Betfair; and Light says, “a key feature in enabling our partners to compete is having a deep market offering that includes highly localized sports that boost player acquisition, with volumes enhanced by risk management that generates strong margins and higher revenues for our operators.”

He adds: “This granular focus on trading and providing a vast choice of markets to players is a key differentiator for us and, along with personalisation and gamification, is a key tool in enabling our operators to compete.”

Giant neighbors

For U.S. operators, the fact that the American market has become an effective duopoly and the top four betting brands control around 85% of the market means looking south for new markets to develop is an obvious step.

Rush Street Interactive is already active in Colombia, and MGM – via its LeoVegas subsidiary – has made inroads in South America, while its BetMGM joint venture partner Entain has major plans in Brazil.

Lenoble says that in markets outside of Latin America, “many sports bettors are motivated to bet because they want to win money or bet on teams that they support.” In the U.S., the strong heritage of fantasy sports means there is a greater interest in individual athletes, and this has created significant interest in player props and player-focused parlays.

This history has enabled sports betting to quickly become deeply ingrained in the wider U.S. fan experience and has “given rise to the concept of the recreational bettor who is betting on the game to truly enhance their personal enjoyment.” As the Brazil sports betting market continues to evolve with regulation, “we will see the emergence of behavioral trends among the region’s sports bettors” and with U.S. expansion slowing, “operators are placing more focus on product improvements as well as enhancing the user experience to generate more revenue from existing customers,” adds Lenoble.

These personalization and gamification features will play key roles in Brazil and Light notes that “they have been happening for some time” across the board already.

“Targeting user data to offer highly targeted bets to players according to their history and customer levels is enabling operators to maximize lifetime values, segment the player-base and implement strong personalisation features,” he says.

As operators, providers and affiliates continue to jockey for position in Brazil and other Latin American countries, competition levels will be intense. But amid all the noise and fury of a Brazil market that is predicted to generate revenues of $9.7bn by 2028, the key will be attention to detail and providing deep and broad offerings to attract and retain players.