The completion of the $1.2bn acquisition of NeoGames by Aristocrat Leisure is another milestone in the transformation of the Australian group, just as the icasino supplier space is evolving stateside.

To describe the moment as an inflection point would probably be overblown, but new industry trends seem clear, for Aristocrat and its Anaxi digital division of course, but also for immediate peers and the leading suppliers they are competing with.

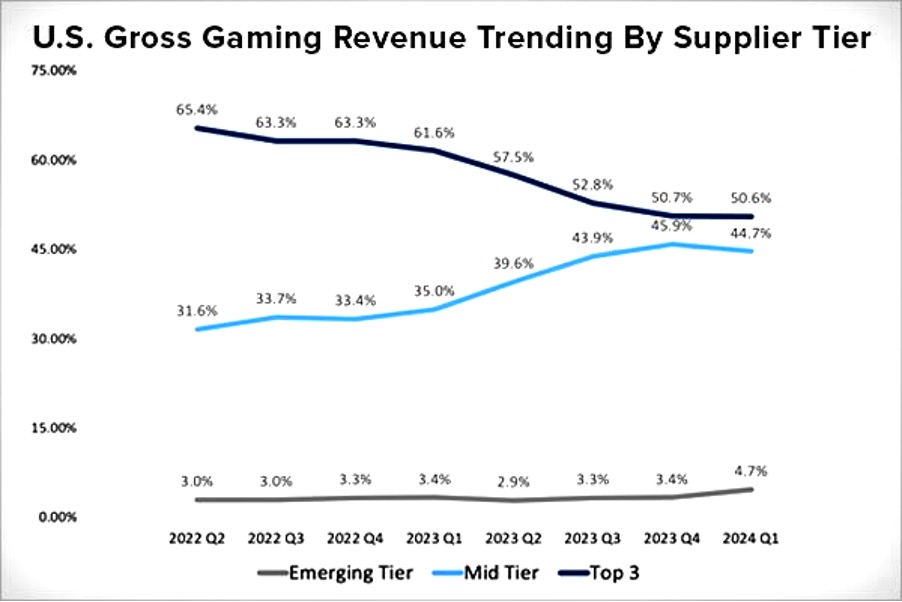

Chris Lynch, managing director of gaming and leisure at Citizens Bank, recently posted research from Eilers & Krejcik Gaming on X/Twitter showing that in the first quarter of 2024 the industry’s three major suppliers, Light & Wonder, Evolution and IGT, were “trending downward” while mid-tier suppliers such as Games Global, High 5 and Anaxi/Aristocrat “are becoming increasingly relevant as demand for differentiated content grows”.

Source: Eilers & Krejcik Gaming

The research, published in April, added that “the top three suppliers in U.S. online casino (Evolution, IGT and Light & Wonder) accounted for 51% of industry GGR,” but this was “down from 65%” two years ago.

“Conversely, mid-tier suppliers (those outside the top three and with more than 1% of GGR) were at 45% of revenues in April, up from 34% in 2Q22, reflecting a more competitive, fragmented market,” EKG pointed out.

Among the mid-tier suppliers, EKG included: Games Global, Everi Holdings, White Hat Gaming, AGS, Konami, Gaming Realms, Anaxi, High 5 Games, Greentube, Inspire, Design Works Gaming and Reel Play.

Commenting on the changing figures and the reasons behind them, Lynch tells CDC Gaming that “there is a growing focus on quality over quantity and often times smaller studios are able to produce the most differentiated content”.

Market changes

As for whether it was operators, suppliers or consumers who were driving these trends, Lynch says that “while operators are responsible for the purchasing decisions, ultimately demand is driven by what the consumer desires”.

Kevin Dale, chief executive of the online casino tracking specialist eGaming Monitor, notes that several different factors were behind the changes. “More studios have obtained licenses and entered the market: there are 55% more studios active in the U.S. compared with last year (167 vs 108), while U.S. operators feel a certain need to compete on the breadth and depth of content, so are actively looking for the best games (as they do in other markets).

“The market is also slowly maturing; consumers first play games that they know from offline casinos/retail stores and then move towards more original content from some of the newer providers, especially from those that have more innovative content such as crash games or Megaways,” Dale explains.

Along with the rise of new online casino content, from the two mentioned above to streamed casino play and game show concepts, CDC Gaming asks Dale if the vertical was feeling the impact of operators cross-selling and the fact that sports bettors might be less attached to certain games in comparison to icasino-first players.

“It’s certainly much easier for a digital customer to move from one ‘machine’ to another and online operators are not limited by floorspace. Similarly, when operators see specific games working well elsewhere, these games are much easier to move to premium floorspace such as top of ‘featured’ or the ‘home’ page,” says Dale.

Scarcity value

The fact that icasino is only regulated in seven states also leads industry observers to question whether there is enough demand and space for hundreds of suppliers to grow as EU markets have.

Lynch says, “in some ways, the slower market growth has created opportunities for suppliers as operators are looking for new and innovative content to drive growth in the absence of new state legislation,” while for Dale the U.S. is “a big enough market and is still far from saturated, if only seen in terms of the number of studios active there”.

Dale adds: “A mature market such as Italy has 320 studios offering content to operators, twice the number active in the U.S. Even a market the size of Denmark has over 300 studios working in it, so this trend towards a higher share among small or medium-sized suppliers has a way to go yet.”

Of more interest to igaming companies looking for new and potentially lucrative revenue streams is the recent focus on interactive lottery products. The significance of the overall product segment was highlighted by DraftKings’ acquisition of JackPocket; and companies like Inspired Entertainment and NeoGames are key movers in the field.

Lynch says: “gaining exposure to the ilottery market provides a meaningful incremental growth opportunity for Aristocrat,” while for Dale, the inner workings of the vertical are interesting, especially when considering the corporate moves that have led to the current industry scenario.

“Scientific Games, the lottery supplier, split away from Light & Wonder as a casino supplier just as lottery operators are crying out for more content from more suppliers. In the past lottery operators had one supplier for both draw games and scratchcards/instants. The advent of ilottery has mixed things up and (having) multiple suppliers is now the norm, even if this mix was generally limited to specific verticals of their content needs,” says Dale.

So, while a firm like Scientific Games might be running draw games and scratchcards for lottery operators, NeoGames would operate the ilottery platform along with some instant games and sports betting. “Over time,” notes Dale, “lottery operators have become more comfortable with multiple suppliers even in the same vertical, so they might look to add an IWG (Instant Win Gaming) alongside IGT for their instant games, for example.”

Major opportunities

As the industry evolves, “we’re now at the stage where [a request for proposal] from lottery operators actually require[s] ilottery platform providers to source content from third parties,” says Dale. “This is huge and the ilottery space will start to look more like the casino one. The only issue here is that there are only a handful of suppliers of lottery instants currently, so this is a real market opportunity. In that sense, the Aristocrat/Anaxi play makes total sense.”

Returning to online casino, Dale explains that in contrast to some of the major suppliers such as IGT, newer providers such as Games Global or Pragmatic Play are “more nimble and less restricted by the need to launch omnichannel games and are already market leaders in many mature markets (live casino excepted)” and this move away from the ‘Big 3’ domination could expand across the U.S. market in the next few years.

As for Aristocrat and its interactive plans, they will surely depend on how productively NeoGames’ real money gaming platform, sportsbook and games development capacity – along with that of the Roxor Gaming studio it acquired in 2022 – are implemented to take advantage of the shifting market conditions in the U.S.