Against a “resilient” Standard & Poor’s Index, Truist Securities analyst Barry Jonas saw gaming-related stocks as underperforming. He shared his views in an October 23 investor note.

Jonas wrote, “While the fear of a large, deep gaming downturn seems to have passed for now, investor sentiment still seems to reflect consumer malaise.” He added that the fundamentals of the gaming group were still steady but “uninspiring.” He lowered his estimates for land-based casinos while predicting flat results for the tech sector and real estate investment trusts (REITs).

As Jonas saw it, local and regional casino operators have been struggling to achieve flat numbers, while those on the Las Vegas Strip are fighting a Vegas-has-peaked narrative. Were interest rates to cooperate, he continued, 2025 would see operators merging and buying one another, after a tech-heavy merger-and-acquisition year in 2024.

Golden Entertainment was pegged as a company likely to sell its assets and lease them back. Churchill Downs, conversely, was seen as a buyer and Caesars Entertainment as a company likely to spin off properties to reduce leverage.

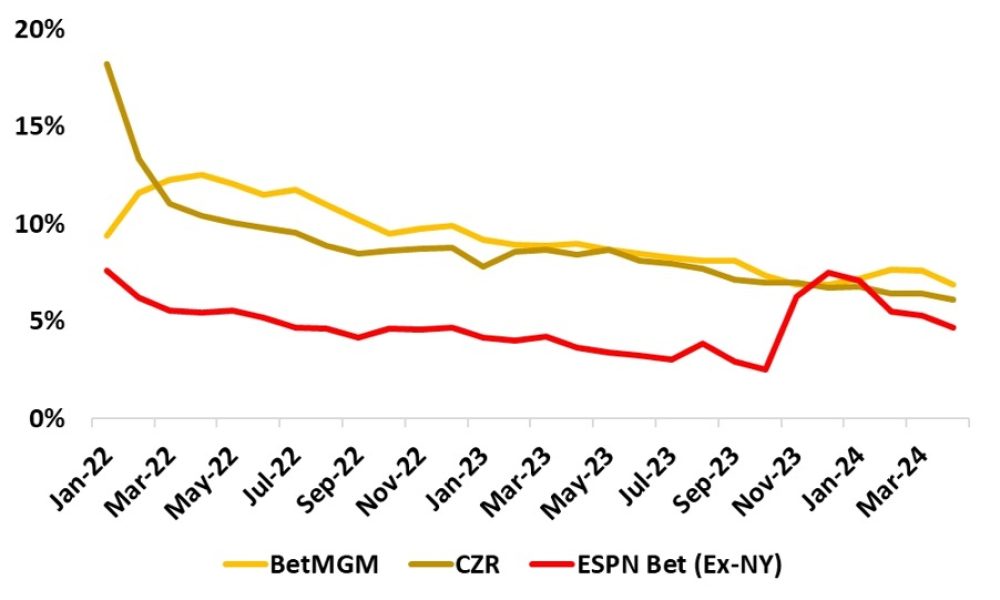

The lone bright spot was discerned to be growth in the digital sector, led by DraftKings. Jonas conceded that his arguments for growth in ESPN Bet are still unrealized. He observed that the tech sector “remains noisy,” with Light & Wonder a good value after its Dragon Train setback.

Jonas changed a number of his price targets. Upward movers were Boyd Gaming (from $75 per share to $77), Monarch Casino Resorts (from $75 to $82), and Everi Holdings (from $10 to $14.25). Ceding ground were Penn Entertainment (from $25 to $23), Station Casinos (from $63 to $58), MGM Resorts (from $58 to $56), Golden Entertainment (from $38 to $36), and Light & Wonder (from $120 to $115).

The Federal Reserve’s recent interest-rate reduction was seen as potentially sparking a wave of M&A activity amongst the gaming group. Vici Properties, Gaming & Leisure Properties, and Caesars were seen as particular beneficiaries of the Fed’s clemency, with Caesars having significantly outperformed the group since the rate cut.

The analyst expected M&A to pick up following the November 5 election, which he said was engendering weakness in consumer spending. “General political uncertainty often leads consumers to err on the side of caution and save their money,” he explained.

As for his rationale for a pickup in merger activity, he wrote, “Gaming REITs are always on the hunt for accretive sale leasebacks; operators may be looking to right-size depressed valuations or to drive growth via synergies in an otherwise flattish environment; and private equity could look at more operator acquisitions after multiple gaming tech deals this year.”

Jonas viewed softness on the Vegas Strip as more a function of difficult year-over-year comparisons than a structural weakness. He also noted that gambling and baccarat revenue are up for the year, monthly fluctuations aside.

He conceded some concern about the fourth quarter, “given the importance of the second annual F1 race that is well-known to be tracking behind on bookings.” Caesars expressed some worries related to online room bookings, which Jonas felt would impact MGM as well.

“Looking past 2024, we have some conviction that Vegas still has room to run,” Jonas argued. He pointed to “very strong” Consumer Electronics Show bookings, along with MGM’s Marriott alliance, as well as the subtraction of the Mirage and Tropicana Las Vegas from the room inventory.

Regionally, casinos were only incrementally above 2023 numbers in the third quarter and Jonas cited a cooling-off in merger talk after speculation about a Boyd takeover of Penn waned. Caesars was battling continued softness, with management focused on curtailing promotions and maximizing margins at the expense of gross gaming revenue per se.

However, Caesars was perceived to be receiving a boost from new properties in Nebraska, Oklahoma, and Virginia, plus the revamped Caesars New Orleans, which is seeing line-of-credit demands around late-October Taylor Swift concerts that rivaled Super Bowl requests.

Allowing that all operators had suffered from regional softness, Jonas liked Churchill Downs “given its unique organic growth levers.” New projects in Virginia and Kentucky were expected to lift the company, along with improvements at the eponymous racetrack in Louisville.

Calling the Las Vegas locals market “somewhat of a question mark,” Jonas wrote that challenges continue to face Station, despite continued growth at Durango Resort, now in expansion mode.

The analyst preferred Boyd, “as the stock’s had a nice run since hitting lows in May … though we believe it remains in value territory.” He liked its 82 percent revenue growth at the new version of Treasure Chest in Louisiana,and said he was looking forward to hearing more about its Norfolk, Virginia, project, taken over from the Pamunkey Tribe.

Locals operator Golden “has seen a tough couple of quarters of late, as its lower-end demo has been squeezed and Atomic Golf has started slow at the Strat.” The company maintained optimism for the fourth quarter, particularly in terms of year-end bookings.

DraftKings remained Jonas’ prime pick in the digital sphere, “given superior tech, strong customer acquisition trends, and meaningful [free cash flow] generation in the coming years.” Although NFL betting results were merely “favorable,” Jonas perceived strong customer acquisition and felt fourth-quarter projections were conservate. Still, he projected cash flow for 2024 of $380 million, not Wall Street’s more optimistic $395 million.

Jonas noted some mild adversity at Penn/ESPN Bet’s retail sports books, “but four new projects should drive upside in 2026, while the key investor focus is digital. We continue to believe PENN’s Interactive offering is undervalued by investors, with ESPN Bet not being given much of a chance to succeed.”

Taking a contrarian view, Jonas argued that ESPN Bet had a path to success “amidst an investment-light re-introduction this football season, as the value proposition provided from the legacy ESPN media app could be somewhat meaningful to legacy OSB customers currently with other platforms.”

He said that between complete ESPN account linkage in November and a standalone Penn igaming app launching early next year, he will be closely monitoring state-level results. “While we sense some investor impatience, we continue to believe there are multiple ways for Penn’s stock to work from here.”

REITs were described as S&P underachievers, but gaming group overachievers. He felt that, in light of Vici waiving its option on two Caesars racinos in Indiana, it had other compelling uses for its capital.

Gaming & Leisure was seen to be more active, including discussions about buying into potential New York City megaresorts. Jonas also noted a “robust” project pipeline, including Penn-led casinos in Illinois, Ohio, and Las Vegas. Its joint ventures with Bally’s Corp. in Chicago and Vegas went unmentioned.

Jonas had just returned from Global Gaming Expo and said he would “remain bullish on the prospects for slot manufacturers and wider gaming tech.” Light & Wonder, he believed, would lose little casino floor space, even without Dragon Train, whose second iteration remained at least three months (plus regulatory approvals) distant.

Another stock he felt was under-appreciated was Inspired Entertainment’s, “which should see momentum as its hybrid dealer and virtual products accelerate (INSE recently announced a hybrid deal with FanDuel) and likely has M&A optionality.”

Jonas also expected “a noisy quarter” from International Game Technology, now solely a lottery firm. Still, he anticipated little movement on the stock until an Italian lottery contract is concluded, and a sale of digital and gaming operations to Apollo Management is finalized.